A mid-year budget report is providing a first look at how Fremont will navigate an accounting blunder that will force the city to repay tens of millions of dollars to the state.

The miscalculations began in 2022, when Fremont started receiving unusually high quarterly sales tax allocations from a California tax agency.

The unexpected cash, totaling $37 million in total, was a financial boon for the East Bay city of 225,000. At the time, city officials attributed the revenue to “higher than anticipated” receipts of auto sales taxes. They quickly revised their revenue projections upward, counting on the continued payments through 2025, and potentially beyond.

But those rosy projections gave way in November, when the state said the payments were made in error, and advised Fremont it would need to repay most of its windfall.

At the time, Fremont didn’t know how much exactly the city would owe. Just last month, the final number finally came down from the state: $20 million over the next two years, a significant amount for a city with an approximately $300 million annual budget.

So will the city have to make major cuts to meet their obligations? So far, officials insist they won’t need to do so. Because they were wary of the payments to begin with, the city had established a reserve fund to prepare for this eventuality. It also has extra money from unfilled salaried positions.

“We were lucky we had put this one-time funding in these reserve accounts,” said Geneva Bosques, the city’s communications director. “We think it’s going to be OK.”

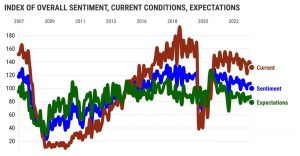

Beyond the immediate burden of repayment to the state, the city also has to grapple with faltering revenue projections. The city is now projecting as much as a $50 million decrease in sales tax revenue this year, and an ongoing $34 million dip in coming years.

Although the city says the reserve fund will cover their payments this year, expenditures are also being cut by $9 million, millions of which come from reduced spending on street, building, and parks maintenance. They city may need to use over half its reserve fund to cover the revenue shortfall.

David Persselin, the city’s finance director, has blamed the state for its sales tax woes. California, ultimately, calculates sales tax — not Fremont. Depending on the nature of the transaction, sales tax payments could be allocated to Fremont, to a state or county pool, or another jurisdiction entirely. Although the specifics of sales tax reporting are confidential, it’s likely that the overpayments were the result of businesses misreporting certain types of transactions, according to Persselin.

In an earlier statement, the California Department of Tax and Fee Administration said it does not disclose information on specific taxpayers due to confidentiality laws. A spokesperson did, however, acknowledge that it was the department’s responsibility to “ensure that the local tax is allocated to the proper jurisdictions”.

Related Articles

San Mateo County approves Moss Beach affordable housing project

Oakland faces $177 million budget shortfall after once again overestimating home sales

Los Gatos council allocates $60,000 for ongoing support of town’s unhoused

Letters: Nation’s divisions | Tiresome claim | Campaign justified | The real race | Global funding | Ensure access

California schools gained billions during COVID-19 pandemic. Now the money is running out

Kelly Abreu, a Fremont resident who has followed the sales tax saga, has disputed the city’s narrative and expects major cuts in 2025 and thereafter.

“City labor contracts, compensation schedules, and staffing levels were ratcheted upwards based on the inflated forecast for sales tax revenues,” Abreu said. “The contingency reserve will be insufficient to cover the ongoing, recurring $34 million drop in sales tax revenues.”

Regardless who is to blame, community members such as Abreu worry that the city is papering over key budget issues that could arise down the road.

“They’re saying in the future everything will be fine,” Abreu said. “But it’s like forecasting your salary is going to double two years from now.”

Underscoring Abreu’s concern is the knowledge that the city’s financial predicament could have been even worse if it had failed to establish a reserve fund, or if the state had requested a higher repayment.

But at least the outcome of the sales tax error is proof that Fremont’s financial future is in good hands, according to city officials.

“This is the exact reason we have a reserve fund,” Bosques said. “Financial stability is a really important goal of our council.”