The CZU Lightning Complex wildfire that burned through the Santa Cruz Mountains in late summer 2020 was a wakeup call for Frank Bäuerle. He wasted no time fireproofing his Ben Lomond home and neighborhood, clearing brush and screening vents against flying embers to bolster his property’s resistance to flames.

But even as his neighborhood got certified as a “Firewise Community,” his longtime insurer, Farmers, discontinued his policy citing geographic characteristics like the property’s slope and nearby woods as a reason, he said, leaving him scrambling for new coverage expected to double his insurance bill.

“I could have had a concrete bunker with no windows and still couldn’t have gotten insured based on that formula,” said Bäuerle, 60, a UC Santa Cruz math professor.

Insurance Commissioner Ricardo Lara in 2022 announced a requirement that insurers provide discounts to consumers for wildfire mitigations and clarify the basis for their homes’ wildfire risk rating.

But amid an accelerating California insurance market meltdown, homeowners like Bäuerle are frustrated that they aren’t getting much if any credit for undertaking often costly measures to make their properties more resistant to wildfires as state officials have called for.

Adding to the problem, insurers are discontinuing coverage of homes even after customers make fire protection modifications. And at least one — Farmers — has referred customers to a group that certifies the completion of more than a half-dozen fire safety mitigations — and charges the homeowners $125 for the service. The commissioner’s mandate was that consumers wouldn’t have to pay for home hardening certification and would be credited for each individual mitigation.

There’s no question such measures benefit homeowners and their communities regardless of insurance benefits. Structural improvements to a home can reduce wildfire risk up to 40%, and when combined with vegetation modifications can reduce vulnerability up to 75%, according to Moody’s.

Neither Lara’s office nor the insurers themselves can say how many homeowners have qualified for and received the discounts. The department says it’s approved 140 insurer discount plans, but acknowledges many companies have yet to implement them.

The California FAIR Plan, the last resort, high-risk insurance for those who lose regular coverage, introduced the first fire protection discount plan last August. But it requires homeowners to complete multiple mitigations to qualify, contrary to the commissioner’s directive.

Deputy Insurance Commissioner Michael Soller said the home-hardening credit program is still in its early stages and that once fully implemented, it will provide consumers with important new benefits. They’ll get financial rewards for every step they take to fireproof their property, and transparency from insurers on what they see as wildfire risk concerns so homeowners can make changes or challenge their risk scoring.

“I think we’re making progress,” Soller said. “This story is still being written. We’re not all the way there.”

Farmers spokesman Luis Sahagun said the company offers its customers both community and property-level mitigation discounts. Sahagun and Soller said the Department of Insurance is working with Farmers’ on a new risk rating plan with discounts that are awarded for individual wildfire mitigation measures as required by the department’s regulations.

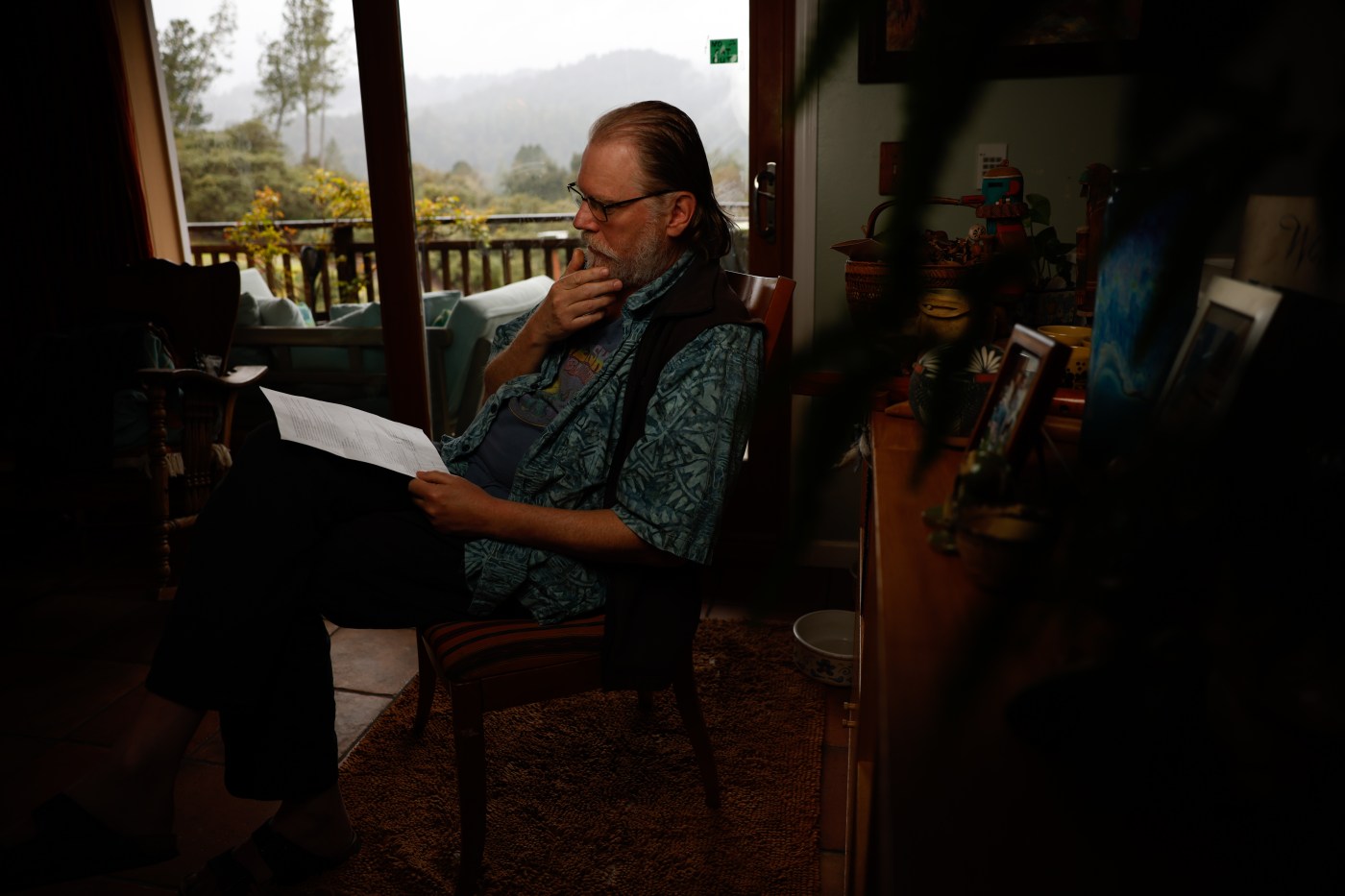

Frank Bauerle looks at his insurance nonrenewal notice at his home in Ben Lomond, Calif., on Friday, March 29, 2024. Frank Bauerle has taken many steps to fireproof his Ben Lomond home, steps that state officials and consumer advocates encourage and promise rewards for those who take the steps. But his insurer, Farmers, discontinued his coverage. (Shae Hammond/Bay Area News Group)

The state of California has experienced a home insurance exodus as losses from fires and other natural disasters mount. Over the last 10 years the Golden State has suffered 14 of its 20 most destructive wildfires on record, with insured losses topping $45 billion, according to the Insurance Information Institute.

Insurers have complained the state doesn’t let them collect enough in premiums to cover their rising costs and risk, and as a consequence, those companies have dropped coverage for tens of thousands of homeowners, particularly in areas considered higher risk for wildfires.

Lara plans to deliver regulatory changes by the end of the year to satisfy insurers’ biggest concerns, while extracting from them a commitment to offer more policies in areas at higher risk of wildfires. But those efforts haven’t calmed the state’s imploding market, where it’s biggest insurer, State Farm, just announced it will discontinue coverage for 72,000 homes and apartment buildings.

The situation angers homeowners who are doing what they can to save their homes and their insurance.

“Getting that wildfire-prepared home designation is hard for a lot of households, and we don’t want people to lose their insurance when they can’t check all those boxes,” said Amy Bach, executive director of the United Policyholders consumer group, which has pushed for homeowner credits for wildfire safety.

The FAIR Plan offers a two-tiered home hardening discount program. Homeowners can get a 10% discount for structural wildfire hardening of their home, and a 5% discount for hardening the home’s immediate surroundings. Those who meet requirements of both can get a total of 14.5% off their bill. And those who live in areas that implement broader “Firewise Community” protections can qualify for an additional 10% discount.

To qualify for the structural discount, homeowners must meet all of five of the following criteria:

A “Class A” rated roof of asphalt fiberglass composition shingles, stone, concrete or clay tile, or metal.

Noncombustible material such as concrete or metal along the bottom six inches of all exterior walls.

Vents must be ember or fire resistant with approved wire mesh coverings.

Windows must be multipaned or fully covered by shutters.

Eaves must be enclosed.

To qualify for the immediate surroundings hardening discount, homeowners must meet these four criteria:

Maintain an ember-resistant zone of clearance within 5 feet of the entire dwelling.

Clear vegetation and debris from under decks.

Remove combustible sheds or other outbuildings within 30 feet of the home.

Regularly trim trees, clear brush and remove debris from their yard.

Most homeowners already meet some of those criteria in each discount category or can do so at minimal cost. All but 1% of California homes have Class A rated roofs — California moved away from Class B roofs like wood shingles after the 1991 Oakland Hills fire. Removing vegetation and debris near the home and installing wire mesh over vents are low-cost fixes.

But other measures can be far more costly or complicated. Chris Finnie, 73, of Boulder Creek, who had to get FAIR Plan coverage after her insurer discontinued her policy following the CZU Lightning Complex Fire, said her lot size didn’t leave enough room to move her shed 30 feet from her house. And when she looked into enclosing her open eaves with soffits, she was told it would cost $40,000.

“I don’t have $40,000,” said Finnie, who’s retired.

Edan Cassidy, an independent insurance broker in Scotts Valley, said most homeowners can qualify for the FAIR Plan’s 5% immediate surroundings discount, but only some are able to get the larger 10% discount due to the structure of older homes and retrofit costs.

“As a mountain resident, I can attest that it is a lot of work, very expensive, or virtually impossible,” Cassidy said.

For homeowners like Bäuerle, the fire protections he labored on are “still valuable even if it doesn’t necessarily get us into a better place with insurance.”

Frank Bauerle looks at his insurance nonrenewal notice at his home in Ben Lomond, Calif., on Friday, March 29, 2024. Frank Bauerle has taken many steps to fireproof his Ben Lomond home, steps that state officials and consumer advocates encourage and promise rewards for those who take the steps. But his insurer, Farmers, discontinued his coverage. (Shae Hammond/Bay Area News Group)

“I know I live in an area that has a non-zero probability of going up in flames,” Bauerle said, but he added that after losing his regular home insurance, replacement coverage is likely to double his bill from $2,500 to $5,000. “There has to be a resolution for people getting priced out of their own homes.”