By Kimberly Palmer | NerdWallet

Social media, which popularized concepts such as loud budgeting and cash stuffing, can be a great place to get new ideas about how to manage your money. But endless scrolling can also lead to envy, romanticizing unattainable goals and exposure to faulty advice.

“Lots of bad information is delivered over social media that’s just inaccurate,” says Kristy Archuleta, professor of financial planning, housing and consumer economics at the University of Georgia. “It’s hard for someone who may not have had a lot of life experience or financial knowledge to be able to navigate what’s accurate and what’s not.”

To find helpful money tips on social media while leaving the harmful ones behind, financial experts recommend taking these steps.

Recognize the limits of what you see online

Whatever you see online is probably not a complete picture of the other person’s life, says Malcolm Ethridge, a certified financial planner and host of “The Tech Money Podcast.”

Someone might post a photo of them posing with a boat or fancy car, which could make you feel like you should own those luxury items, too, Ethridge says. But in reality, the person posting those images might not own them, either. “Social media induces conspicuous consumption that happens unnecessarily,” he says.

A 2023 NerdWallet study found that nearly two-thirds of Americans (65%) believe social media has led to increased overspending. In addition, 18% of Americans say they have made a regrettable purchase as a result of something they saw on social media.

Double-check advice and credentials

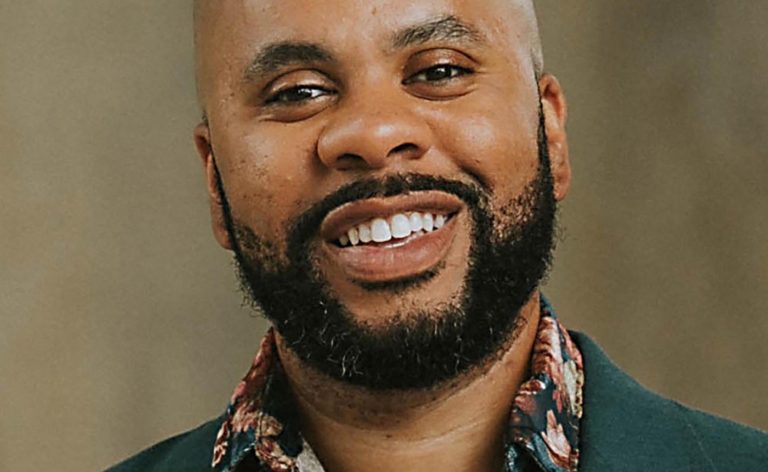

When you hear specific financial advice on social media, financial therapist and accredited financial counselor Rahkim Sabree suggests first checking the credentials of the advice-giver.

“A lot of influencers provide information that is very subjective,” he says, and their advice may apply only to a subset of people, such as those with no debt or those who have significant investments.

One red flag, Sabree says, is speaking in absolutes that suggest everyone should always take a specific action, since financial advice is rarely one-size-fits-all. “They might be promoting a particular product like life insurance or an investment strategy around real estate or crypto,” he says. He recommends being wary of anyone promoting a specific product or strategy without knowing your unique circumstances.

Ethridge suggests searching influencers’ names for negative reviews or feedback from others before listening to their advice. “One of the biggest mistakes people make is accepting what they see at face value,” he says.

Ethridge adds that he’s had to help clients undo some of the real estate and tax decisions they made after getting bad advice on social media. “It’s not uncommon for people to give tax advice on social media who have no idea what they’re talking about,” he says.

Seek out new perspectives

One of the benefits of learning about money on social media is that you can find viewpoints you wouldn’t normally discover in person, says Kyla Scanlon, financial influencer and author of the forthcoming book “In This Economy? How Money & Markets Really Work.”

“You can be scrolling along and then you might see a video that changes how you think about budget planning, or the economy or investing,” Scanlon says. “You hear voices that might not have gotten a platform previously and from all sorts of backgrounds and experiences.”

Block negativity

Since negative posts tend to get more attention online, it’s easy to get sucked into a spiral of stress and worry when scrolling through social media, Sabree says. He recommends avoiding posts that make you feel bad about your own choices. In the personal finance world, he says, many popular influencers rely on shame and guilt to get attention, but you might not find that helpful.

“Freaking people out gets views. Most people who make finance content scare people because that’s what the algorithm rewards,” Scanlon says. That’s why, she adds, “it’s up to consumers to be cautious and make sure they’re not getting roped into a doomsday cycle.” Blocking posters who trigger negative feelings can also help.

Take social media breaks

When Scanlon notices her stress levels rising after spending a lot of time on social media, she gives herself a mental break. “I try to remember it’s not real,” she says.

At the same time, Scanlon recognizes the power of social media to do good, and tries to leverage that to help others by spreading financial knowledge. “For all the bad that comes with social media, there are also very good things,” she says.

More From NerdWallet

Money Management: 4 Tips for Mastering Your Finances

5 Ways to Calm Financial Stress

How to Stop Spending Money: 8 Ways to Resist the Urge

The article Social Media Money Advice: Avoiding the Bad, Finding the Good originally appeared on NerdWallet.