On paper, the U.S. economy seems to be doing well with historically low unemployment. Yet most Americans have a sour view in recent polls, with stubborn inflation in living costs cited as the reason for that pessimism.

“As the 2024 general election begins in earnest, voters’ assessment of the economy and of the candidates’ ability to manage it will, as usual, have a strong impact on the outcome of the race,” Brookings Institute stated in a recent analysis of economic attitudes. “With little more than seven months until Election Day, the economy remains a key advantage for former President Donald Trump, and a drag on President Biden’s reelection prospects.”

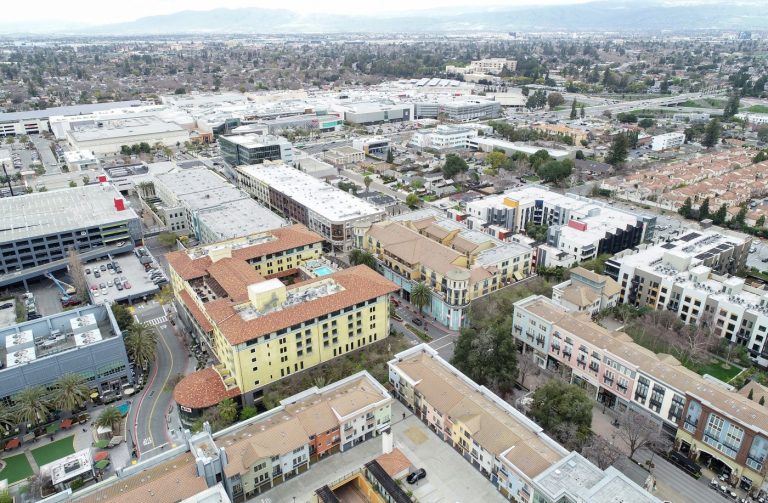

Biden needn’t worry about losing California to Trump, but it has one of the nation’s highest rates of inflation, according to Moody’s Analytics, worsening its already outlandishly high costs of housing and other living expenses. It’s the biggest factor in California having the highest level of functional poverty of any state, 13.2% according to the U.S. Census Bureau, about 50% higher than the national rate.

The Public Policy Institute of California, using similar statistical methodology, has found that a quarter of Californians are either living in poverty or financially close. More recently, the PPIC has explored the impact of inflation, especially on California families which struggle to pay for housing, food and other necessities.

In 2018–19, PPIC reported, “these necessities cost California’s low-income households about $26,000, on average; by 2024, these households would need to spend over $32,000 on the same goods and services. By comparison, the top income group spent on average $82,000 on these basics in 2018–19, which would now cost nearly $100,000 in 2024.”

The PPIC has found that “prices have increased unevenly across goods and services — with varying effects across households at different income levels. Food prices are up 27% compared to April 2019, and gasoline is up 29%. While expenditures on these goods and services make up large portions of most household budgets, lower-income households spend almost all of their resources (83%) on food, housing, transportation (including gasoline), and health care.”

Obviously those on the lower rungs of the economic ladder have more difficulty adjusting to increases in living costs. It’s not hyperbole to say that inflation is a major reason why so many Californians cannot move up that ladder.

Meanwhile, efforts to curb inflation have a compounding effect. The Federal Reserve System maintains high interest rates to cool off the economy and bring down inflation, but those interest rates make home ownership more difficult and affect businesses, which often raise the prices of goods and services to maintain profits.

Inflation also hits the public sector, increasing the costs of providing services and wreaking havoc on state and local government budgets. It’s one of the reasons the state budget suffers from a massive deficit and why many cities, counties and school districts are struggling to balance their budgets.

Related Articles

How a Depression-era law could be used to make booze cheaper

Cash for gold? It’s not easy to make a buck with today’s internet pricing

An obscure option could help Californians without high school diplomas pay for college — if it survives

Cost of drinking water, wastewater services to increase for some San Jose residents and businesses

Costco’s $1.50 hot dog price is ‘safe’

By happenstance, the PPIC issued its report on inflation on the same day that BravoDeal, a website devoted to helping consumers find bargains, released its study of fast food prices, comparing four popular chains state-by-state.

Overall, fast food outlets in Mississippi had the lowest prices while those in Hawaii were the highest, followed by New York, New Jersey and California.

For example, a McDonald’s Big Mac costs an average of $5.11 in California but just $3.91 in Mississippi.

Dan Walters is a CalMatters columnist.