The November ballot is expected to include a $10 billion to $20 billion affordable housing bond measure proposed by the Bay Area Housing Finance Authority. Servicing the debt on $20 billion of new bonds would add an estimated $240 to the property tax on any Bay Area home assessed at $1 million.

While it would be great to improve housing affordability in the Bay Area, there are ways to accomplish this goal without increasing the carrying cost of existing homes.

Measure advocates correctly point to a shortage of new housing units but do not consider the underlying causes. Certainly, private developers are capable of building new homes and apartments without the subsidies that would be funded by a housing bond. RubyHome found that between 2010 and 2022, Texas added almost 2.5 million housing units, which is more than double the number in California, despite its smaller population. And the Texas homes were mostly built privately, without taxpayer subsidies. In the Dallas area, for example, thousands of new homes are on the market for less than $400,000.

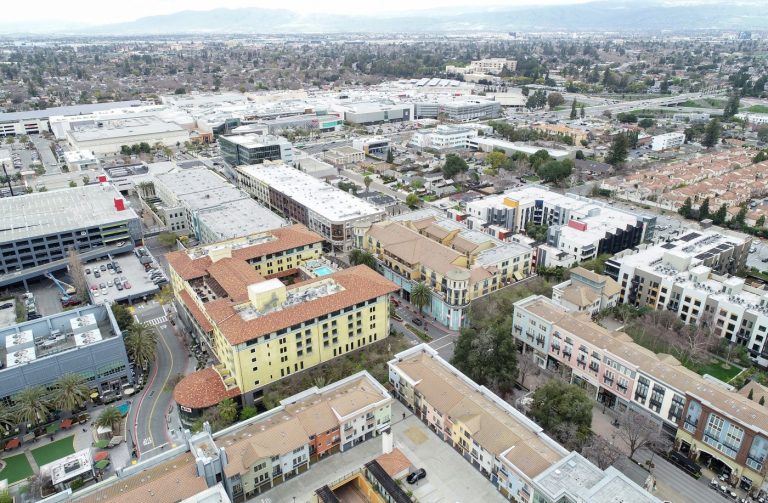

Land costs in the Bay Area are higher than those in Dallas partially because of our superior amenities, but also because so much land is unavailable for development. Over 800 square miles of land are in area parks, totally off-limits to development, and vast additional areas are zoned for agricultural uses with homes limited to about one per acre.

Zoning and other land use restrictions, especially when weaponized by those opposed to development in their communities, have impeded residential construction in the Bay Area. Thousands of new units could come online quickly if private developers could simply execute their plans at the Concord Naval Weapons Station, Point Molate, Brisbane Baylands, the Terraces of Lafayette and other sites without political impediments.

And then there is the California Forever project. With upwards of 60,000 acres of Solano County property in its possession, the development group could easily create more housing units than the bond measure would fund and at no cost to taxpayers — if the county government will allow it.

Beyond higher land values, building costs in the Bay Area are elevated by a range of government interventions. These include permitting and development impact fees that can exceed $100,000 per unit in some cities and restrictions on the use of manufactured housing that would reduce the need to use costly local labor.

Subsidizing housing with bond money could offset the effects of some of these restrictions, but we cannot be sure that units funded by the bond will be built quickly or at a reasonable cost. Los Angeles offers a cautionary tale. LA’s Measure HHH in 2016 made $1.2 billion of bond money available for affordable housing. But it took years to produce a significant number of units and costs are approaching $800,000 per unit. The high costs are partially attributable to California prevailing wage laws, which increase construction worker pay, and project labor agreements, which control on-site work rules and thus reduce management’s ability to efficiently deploy workers.

Related Articles

California homeownership costs jump 32% since pandemic began

Not (officially) in my backyard: Illegal California ADUs outpacing permitted ones

They bought homes with the intention to refinance. Now they’re stuck

Sunnyvale welcomes new affordable ADUs

Opinion: How interim housing could solve California’s unsheltered homelessness crisis

The Bay Area has become a very expensive place to live, and so it is understandable that political leaders want to find ways to improve affordability. But two major drivers of our high and increasing cost of living are our high taxes and government restrictions that prevent the private sector from providing goods and services at low cost. Rather than address unaffordability with another costly Band-Aid, politicians should consider reducing the taxes and regulations that are at the root of our problem.

Marc Joffe is a Walnut Creek resident and a federalism and state policy analyst at the Cato Institute.