“How expensive?” tracks measurements of California’s totally unaffordable housing market.

The pain: Even California workers making more than 75% of all jobs will struggle to buy a home.

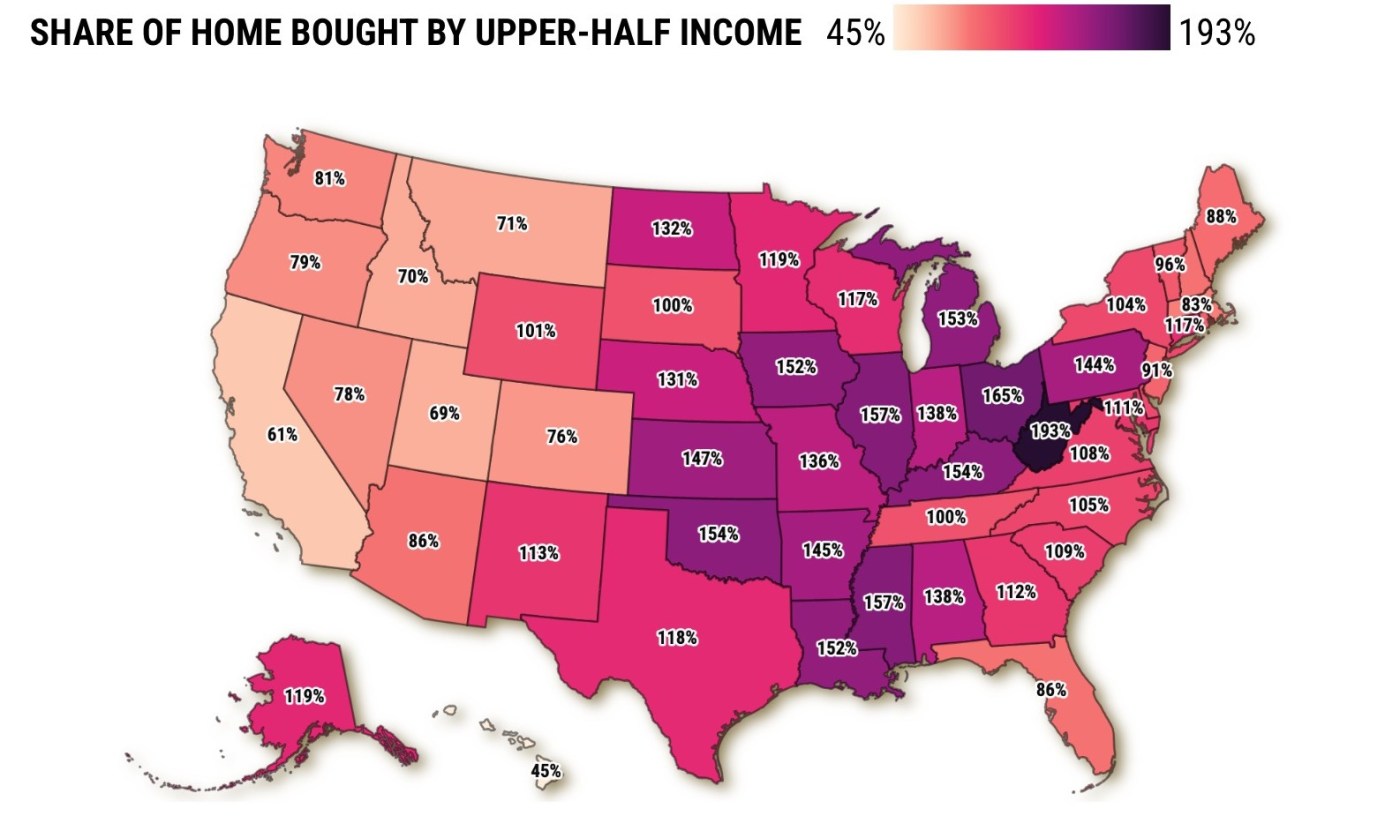

The source: My trusty spreadsheet created an “affordability” index comparing the 75th percentile income in 50 states as of May 2023 – that’s the median of the upper half of all annual wages – from the Bureau of Labor Statistics against the median home value, as tracked by Zillow.

The pinch

In a state where roughly half of all households own their home, it’s not hard to see why the 75th percentile pay is typical for house hunters.

In California this annual pay ranks third-highest in the nation at $93,250 versus $70,035 nationally. That’s 33% higher.

Tops for upper-crust paychecks was Massachusetts at $98,110, then Washington at $95,180. Lows? Mississippi at $55,870, Arkansas at $58,900, and South Dakota at $59,980. California rivals Texas was No. 22 at $72,640 and Florida was No. 30 at $67,600.

Then ponder pricing, California’s bane.

The typical statewide residence was No. 2 costliest in the US last year at $753,800 versus $325,750 nationally. That’s 131% higher. Yes, more than double.

Top home prices were in Hawaii at $848,700. No 3. was Massachusetts at $586,600. Lows? West Virginia at $157,400, Mississippi at $177,100, and Kentucky at $200,300. Texas was No. 29 at $305,600. Florida was No. 17 at $390,800.

The point of pain

Now, think about who can afford to buy a home.

Imagine the buying power of a 7% mortgage for a borrower devoting 40% of those 75th percentage wages to the house payment.

In California, these wages buy you 61% of the typical residence. That ranks next-to-last and well below the 110% nationally.

Only Hawaii was worse at 45%. No. 3 was Utah at 69%. Tops was West Virginia at 193%, Ohio at 165%, and Illinois and Mississippi at 157%.

And Texas was No. 20 at 118% and Florida was No. 38 at 86%.

Jonathan Lansner is business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Related Articles

San Jose approves $5.3 billion budget, diverts more than $23 million from affordable housing to homelessness solutions

Too much affordable housing? Concord rejects low-income project downtown, draws state scrutiny

California’s homeownership rate hits 13-year high — with a catch

California homeownership costs jump 32% since pandemic began

Google ready to launch downtown San Jose village