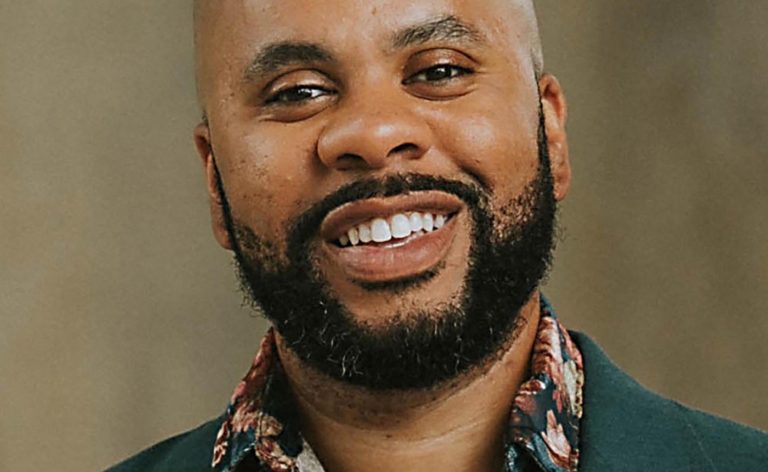

Jonathon Yu is not a professional developer, but he is interested in building new housing.

In 2023, the 29-year-old product manager submitted plans to Sunnyvale to raze the modest 1,000-square-foot bungalow he bought a year earlier and replace it with a three-story, five-unit multifamily building.

He paid a few thousand dollars for an architect to draw up plans, then a few thousand more to the city for application fees. His parents called him insane for spending so much, but Yu had the money, and he wanted to build housing.

He didn’t have the funds for what Sunnyvale demanded next: To get the permit for the $3 million project, he would need to pay $300,000 in impact fees, one-time charges imposed by local governments to fund improvements to infrastructure like roads, parks and schools.

“What stopped me were the impact fees,” Yu said. “If I would have completed the structure, it would’ve been the most affordable new housing in the area.”

Across the Bay Area, impact fees like those Yu encountered often surpass six figures per unit — and developers have had little leeway to challenge them.

But a recent ruling by the U.S. Supreme Court could limit the impact fees that California can levy, which some say could lower the barriers to building new housing.

The case involved California landowner George Sheetz, who challenged the $23,420 fee El Dorado County required to fund road expansions the county said were necessitated by the small home he wanted to build. Sheetz sued, arguing the Constitution’s taking clause limits what the government can take without fair compensation.

Previous cases have required such fees to be “roughly proportional” to a development’s impact. But California courts have held local governments to a lower standard.

In a unanimous decision, the Supreme Court found that was incorrect, and remanded the case to the state court for reconsideration. It’s unclear what new standards the California court will direct cities to adopt, but the fees are likely to be reined in.

“California cities had enjoyed an exemption from having to show their work to justify their fees,” said Dave Lanferman, an attorney specializing in impact fees cases with Rutan and Tucker. “No longer.”

For decades, California has levied some of the highest impact fees in the country. That can be traced back to 1978 when voters passed Proposition 13, which limited the property taxes local jurisdictions could collect. With their ability to raise revenue hamstrung, local governments started looking for new ways to pay for services like schools, parks and transportation projects.

As long as the fees have existed, they have been criticized by developers, who say that each dollar added onto the cost of a project makes it harder to complete.

“These fees are costing us a lot of housing — housing that we never see proposed,” said Dylan Casey, executive director of the California Housing Defense Fund, which sues cities and counties to get them to comply with state housing law.

Many developers acknowledge that such fees are needed to help growth pay for itself — they can help cities acquire new land for parks, expand their libraries, or build new fire stations so that a city can maintain its level of services, even as new residents put a strain on them.

But critics say that for too long, cities haven’t had to justify the fees — and that Sheetz could finally force them to.

“There’s no connection between what cities are charging and what they’re spending it on,” said Matthew Lewis, spokesman for the pro-housing group California YIMBY. “That creates legal hazards for cities and economic hazards for builders.”

Fees like those Sunnyvale charges for parks — which range from $34,121 for a single-family home to $114,498 per unit in an apartment building — are unreasonable, he said.

Sunnyvale maintains that its fees haven’t deterred development in the city. In a statement, a spokesperson pointed out that the city surpassed its goals for market-rate housing between 2015 and 2023.

Most often, the developers hurt by high fees are small-time home builders like Yu, since developers of large-scale projects already tend to negotiate their fees with cities. (Earlier this month, Cupertino said it would waive $77 million in fees for the developers of The Rise, the city’s largest-ever housing development at the former Vallco Mall site.) For cities that don’t negotiate willingly, developers may end up taking them to court with the aim of settling on a lower fee.

Bringing down these fees to what developers say are more “reasonable” levels could help make it easier for small projects as well as large ones to pencil out, stimulating housing production. Even if cities lose out on short-term fees, they could unlock long-term revenue streams generated by new housing — like increased property and sales tax.

“If you do nothing, that’s the worst-case scenario,” said Erik Schoennauer, a development consultant in San Jose. “You’re not getting fees, and you’re not getting housing either.”

Others contest whether lower impact fees would make a significant difference in whether a project pencils out. The fees represent just four to eight percent of a project’s total cost — depending on the city.

An October 2023 study commissioned by San Jose showed that even if the city eliminated impact fees and other local construction taxes in their entirety, most projects in the pipeline would remain infeasible because of high construction and borrowing costs. Even so, the city in June extended a program waiving all city construction taxes and half of the parks impact fees for new high-rise towers downtown — and it is considering similar incentives that would apply citywide.

“Really the question is, what are the conditions that we need to create to build more housing? I don’t think the conversation lies solely with whether we increase or decrease these fees,” said Jean Cohen, executive director of the South Bay AFL-CIO Labor Council. “It’s about a multipronged approach.”

Related Articles

Prime downtown San Jose spot survives — and thrives — despite COVID woes

Rotten Robbie gasoline station owner buys several San Jose buildings

UC Regents OK state-of-the-art $1.49 billion Oakland children’s hospital

San Jose affordable homes project gets boost from creative deal

Empty offices haunt downtown San Jose, Oakland and San Francisco

Drew Hudacek, chief investment officer at Sares Regis, a major Bay Area developer, agrees that impact fees are far from the only cost keeping developers from breaking ground. But any reduction in a builder’s cost gets them closer to a project that makes financial sense, where they can feel confident about future profitability.

“There is a fine line between a city getting the fees to support the services that are needed for that new development, and where the fees can overwhelm a project and prevent it from going forward,” Hudacek said.

Yu acknowledges that impact fees were just one of many barriers he faced — finding financing would’ve been difficult too, and construction costs could have spiked. But the fees were what stopped him from moving forward.

“A lot of these fees are death by a thousand cuts,” said Yu. “Each little dollar does matter.”