SAN JOSE — Plans to sell a big shopping mall in San Jose have hit a speed bump in the form of an uncertain timeline that has emerged at a time of brutally high interest rates and inflation.

Uncertainty over a possible sale of Westfield Oakridge mall in south San Jose emerged on Thursday in materials prepared for an earnings report from Unibail Rodamco Westfield, the France-based owner of many shopping centers on two continents, including two in the South Bay.

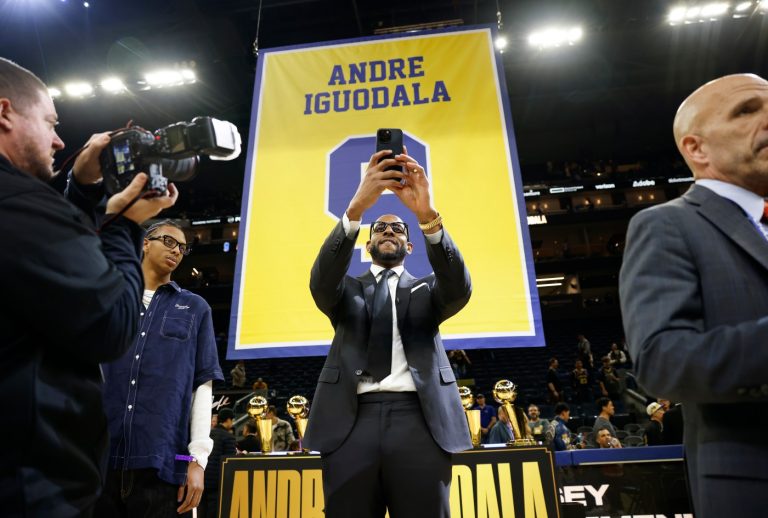

Westfield Oakridge center on Blossom Hill Road in south San Jose. (Unibail-Rodamco-Westfield)

In February 2024, executives with Unibail Rodamco Westfield, also known as URW, disclosed the company had struck a deal to sell Oakridge shopping center for an unspecified price.

At the time, Unibail Rodamco Westfield estimated the deal would be completed sometime during the April-through-June second quarter.

That timeline has now slipped, the company stated in a financial report regarding its results for the first half of 2024.

“On July 11, 2024, URW extended the exclusivity period for the sale of Westfield Oakridge,” Unibail Rodamco Westfield stated in the earnings presentation. “URW had received a nonrefundable deposit of $30 million.”

In real estate and business transactions, an exclusivity period typically refers to a time frame during which a prospective buyer of a property or other asset has the exclusive right to complete the purchase.

Unibail Rodamco Westfield didn’t specify when the deal might be complete.

The company, however, did make it clear that vital components of the current economy in the United States could be affecting the ability of buyers to complete purchases.

“Investment market conditions remain challenging as interest rates stay higher for longer than expected,” Unibail Rodamco Westfield Chief Executive Officer Jean-Marie Trinant said during the earnings call. “Rate cuts in the U.S. have not yet materialized.”

Related Articles

San Jose job hub may sprout at vast site after project lands key loan

Pleasanton threatens to ‘pull the plug’ on Stoneridge Mall project if property owners don’t move forward

Big Silicon Valley tech campus is foreclosed as office market staggers

Big East Bay apartment complex is bought for more than $100 million

Huge San Jose hospital project heads to key public development review

High interest rates make it tough for potential buyers of real estate to obtain financing with the attractive terms they need to purchase a property.

It wasn’t immediately clear if this was the impediment that prompted URW to extend the exclusive period for the prospective buyer to complete the purchase of Oakridge Mall.

The potential price for a Westfield Oakridge deal wasn’t known.

In January, however, Eastridge Center, a big regional mall in east San Jose, was bought for $135 million.

Eastridge Center totals 1.23 million square feet while Westfield Oakridge totals 1.14 million. That makes Oakridge about 7% smaller than the similar Eastridge Center.

What is clear, however, is that Unibail Rodamco Westfield still chases a years-long quest to dramatically slash the number of retail centers it owns as it attempts to whittle down debts and reduce its presence in markets such as the United States.

“We are fully committed to our deleveraging plan through disposals in Europe and the radical reduction of our financial exposure to the U.S.,” Trinant said during the conference call for the financial results.

In at least one instance, URW’s reduction of its U.S. exposure has been wrenching.

In 2023, URW decided to cease loan payments for San Francisco Centre, a landmark retail complex jolted by a succession of retailer exits, including the departure of Nordstrom as the primary anchor of the failed mall. Emporium Centre is the new name of the San Francisco mall.

Unibail Rodaco Westfield also owns Westfield Valley Fair, a destination center that features shops, restaurants and unique experiences. URW has never stated whether it would seek, or has attempted, to sell Valley Fair, which is one of the nation’s most successful malls.

The company stated, nevertheless, that efforts continue to unload malls in the United States and elsewhere.

“The pace at which it goes is slow, but we are pretty confident in our ability to continue our deleveraging through disposals based on the level of active discussions that we have today,” Trinant said.