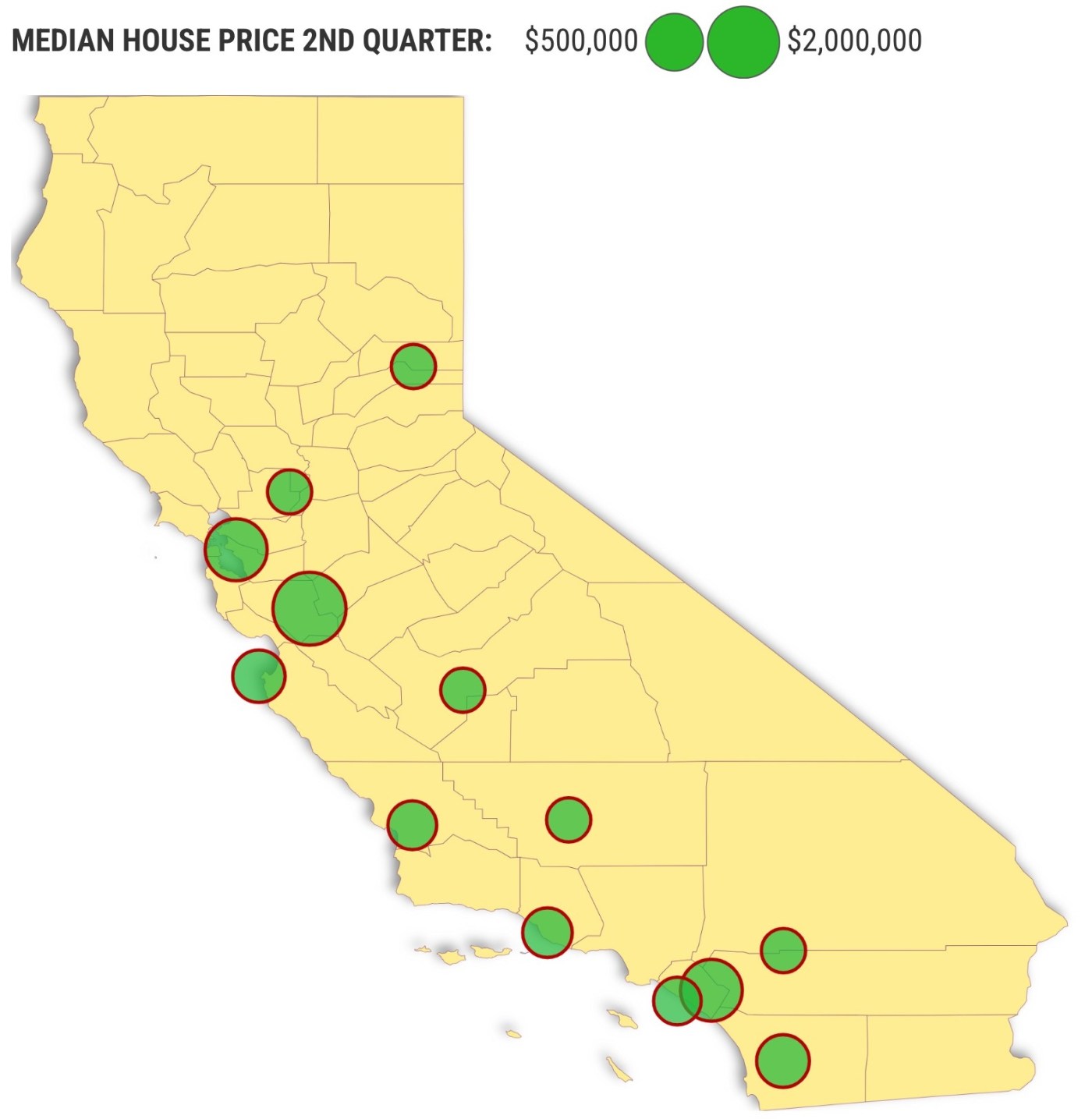

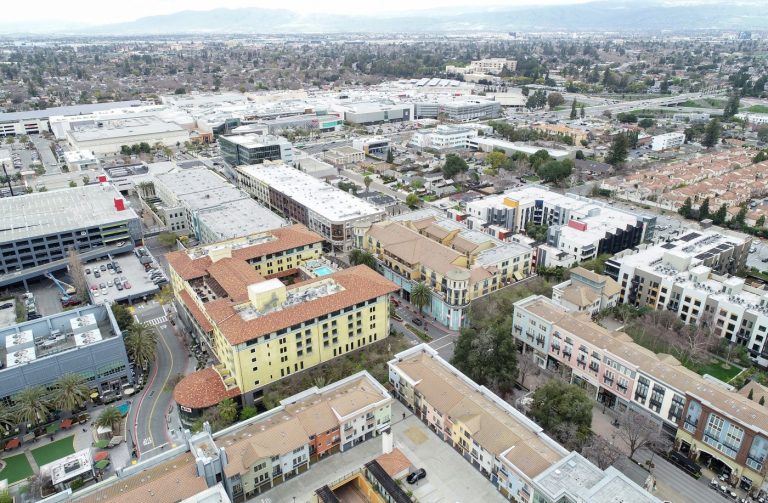

The median home price in Silicon Valley topped $2 million in the second quarter – the first time a US metropolitan area has exceeded that threshold – as California claimed eight of the nation’s 11 priciest places to buy a home.

RELATED: Why the $20 billion Bay Area housing bond could be cut from the ballot

By National Association of Realtors math, the price for an existing single-family house in the San Jose-Sunnyvale-Santa Clara area rose 12% in the second quarter from a year earlier to $2.08 million. No metropolitan area in the country had previously exceeded $2 million, the group said.

Neighboring San Francisco ranked second among most-expensive US metro areas, with the median home price climbing 9% over the past year to $1.45 million. California’s other six in the top 11 …

No. 3 Orange County: $1.44 million – up 15% in a year.

No. 5 San Diego: $1.05 million – up 11% in a year.

No. 6 Salinas: $1.04 million – up 13% in a year.

No. 7 Ventura County: $927,900 – up 3% in a year.

No. 8 San Luis Obispo: $895,300 – up 1% in a year.

No. 11 Los Angeles: $854,800 – up 8% in a year.

Related Articles

Why the $20 billion Bay Area housing bond could be cut from the ballot

Developer scuttles affordable housing project at prime San Jose site

A first-of-its-kind housing project comes to Cupertino

Bill would limit California homebuyer contracts to 3 months

The ‘A’ word: Affordability in housing has become a muddled term

The steep home-price appreciation in the Golden State reflects a broader problem with affordability. Across the US, annual home-price growth for existing one-family houses rose 4.9% to $422,100 in the second quarter, compared with a 5% year-over-year advance in the prior period.

Nationally, 89% of metropolitan areas saw home-price increases in the second quarter. The rate on a 30-year fixed mortgage ranged from 6.82% to 7.22% during the period.

In 48% of US markets, an income of at least $100,000 is required to afford a mortgage with a 10% down payment, NAR data show. In the first quarter, that was the case in 40.7% of the nation’s markets.

“It’s terrific news for homeowners who are moving ahead in wealth gains,” NAR Chief Economist Lawrence Yun said in a statement. “However, it’s difficult for those wanting to buy a home as the required income to qualify has roughly doubled from just a few years ago.”

Typical Payment

The typical mortgage payment was $2,262 a month, up about 11% from the first quarter. Families typically spent 26.5% of their income on mortgage payments in the second quarter compared with 24.2% in the prior three-month period.

Some surprising markets topped the NAR’s list of areas with the biggest annual percentage increases. Racine, Wisconsin and Glens Falls, New York both experienced 19.8% year-over-year home-price growth in the second quarter. However, the mix of homes sold influence the figures, the NAR said.

Meantime, price growth moderated in some real estate markets that had seen rapid growth. In Austin, home prices were flat in the second quarter, while those in Nashville matched the national median home-price gain of 4.9%.