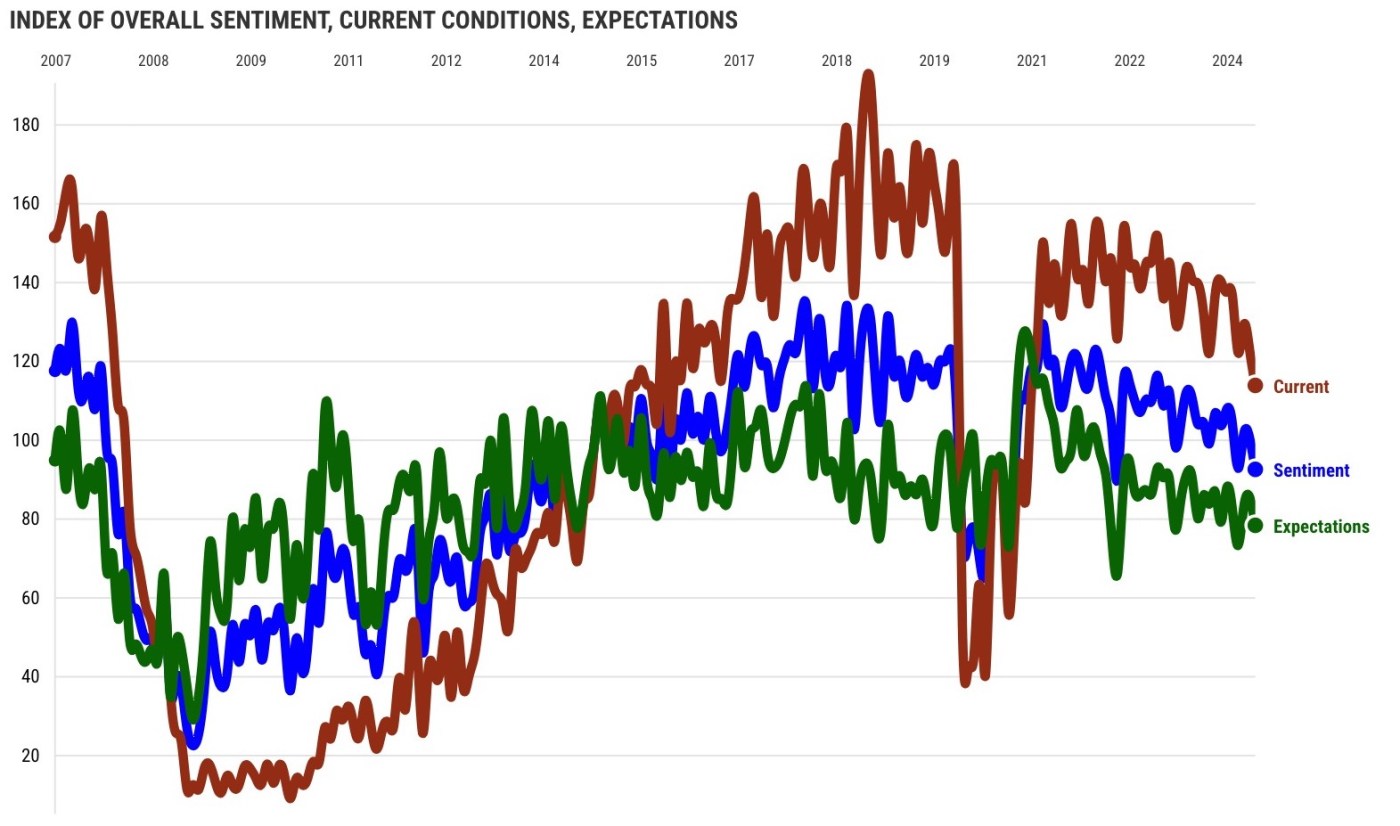

“Swift swings” takes a quick peek at one economic trend.

The number: The Federal Reserve’s war on inflation doesn’t sit well with California’s consumer psyche.

The source: My trusty spreadsheet looked at July’s consumer confidence index from the Conference Board, derived from monthly polling of shoppers for the state and seven others, plus the nation overall.

Quick analysis

Ponder the slippage in this statewide yardstick of shopper optimism.

It’s down 18% in a year.

The last time Californians were this dour was July 2022.

It’s dropped 25% since March 2022. That’s when the Fed began battling inflation with the economy’s kryptonite – higher interest rates. And the central bank’s goal is to chill the spending of corporations and consumers alike.

Or look back to pre-pandemic 2018-19, and you’ll see the confidence index this summer is 21% below those “good-old-days.”

Why the drop? Index math offers a hint: Californians are souring on current conditions.

The confidence index’s present situation yardstick in July was down 21% in a year. It’s not very surprising considering the statewide unemployment rate has run above 5% for 10 straight months, not long after setting a record low of 3.8% in August 2022.

And the confidence index suggests California’s future is relatively less bleak. Its “expectations” measurement is down a mere 14% over these 12 months.

To be fair, being antsy about the economy is not just a Golden State woe – but California’s slide is steep.

The US confidence index is off 12% in a year and 7% since March 2022. But July’s national optimism is 22% below what it was during the days when we didn’t know about coronavirus, back in 2018-19.

Elsewhere

Peek at confidence swings in the seven other states tracked, ranked by the past year’s change …

Pennsylvania: Off 22% in a year and down 22% since March 2022.

Texas: Off 17% in a year and down 1% since 2022.

Michigan: Off 17% in a year and down 4% since 2022.

Illinois: Off 15% in a year and down 14% since 2022.

Florida: Off 14% in a year and down 10% since 2022.

New York: Off 13% in a year and down 8% since 2022.

Ohio: Up 10% (yes, an increase) and up 6% since March 2022.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Related Articles

How long will California remain world’s 5th-largest economy?

How tech industry’s tumble cooled California’s economy

California’s economy grew 1.2% in first quarter, slowest pace since 2022