In many ways, 2024’s summer housing market looks just like last year’s: interest rates are still hovering around 6.5%, inventory remains low and prices keep climbing.

And yet, this year’s summer market has seen a jump in activity, with July sales up 19.2% from the same time last year, according to recently released data from the California Association of Realtors.

So why did sales remain strong this July, when by that month last year they’d begun to decline?

It’s all about how buyers view their interest rate. While rates are now at the same level they were last summer, they’re trending downward rather than ticking up. Where last year, a 6.5% interest rate may have filled buyers with dread, now — with buyers used to rates hovering around 7% the last few months — 6.5% comes as a relief.

“People got tired of waiting for rates to moderate,” said longtime Peninsula realtor Jeff LaMont, of the low interest rates that defined the pandemic era. “We’re not going back to the 2.75% mortgage. The ship has sailed on that, and I think people realize that.”

With both buyers and sellers getting off the sidelines, several Bay Area counties saw sharp upticks in sales volume — the number of sales increased by 24.9% in Alameda County, 30.5% in Santa Clara County and 34.8% in San Francisco.

Inventory has remained low, and paired with high demand, prices are still on the rise. The median price of a home in the nine-county Bay Area rose by 3.6% in the past year, from $1.26 million to $1.3 million, reaching $1.28 million in Alameda County, $916,500 in Contra Costa County, $2.1 million in San Mateo County and $1.88 million in Santa Clara County. San Francisco County saw the greatest increase, a jump of almost 10% to $1.6 million.

Even with prices up from last year, agents say that wealthy tech workers continue to spend big, driving heated competition for a small pool of single-family homes this summer.

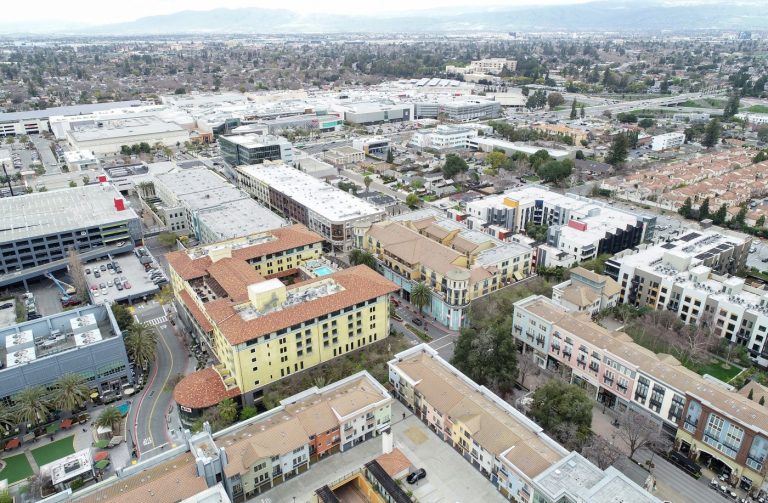

At an open house in San Jose’s lush Willow Glen neighborhood this week, Carlos Pompa, an agent with Keller Williams, said he saw “solid traffic.” Many of his buyers have competed against multiple offers, and he expected this would be no different. The three-bedroom home, listed at $1.99 million, would likely go for around $2.2 million, he predicted.

“There’s so many (all)-cash buyers on the market,” Pompa said. “Interest doesn’t matter to those types of buyers.”

But for buyers reliant on financing, even a few percentage points difference in interest rates can lead to significant savings on a monthly mortgage. The monthly payment for a 30-year mortgage on a median-priced Bay Area home with 20% down would be $7,073 at a rate of 7.22% — the peak in May — versus $6,546 for a rate of 6.46%, the current average.

Despite high rates, Bay Area homes are getting snapped up quickly, with the median time on market in July just 17 days across the nine-county region, and even lower in most of the core counties—13 days in Alameda and Contra Costa counties, 12 days in San Mateo County and nine days in Santa Clara County. Meanwhile, homes in San Francisco sat on the market for 27 days.

With increased summer activity and homes transacting quickly, buyers are having to react fast.

This summer, Rachael Rognerud and her husband, a security engineer, decided to leave their home of 10 years in San Francisco and buy a single-family home in the East Bay where they could raise their one-year-old daughter.

Rognerud spent weeks scanning Redfin and Zillow — but when they found a house they loved, everything came together in less than two days. Within hours of a new listing for a three-bed, two-bath home going up, Rognerud had called her agent to schedule a tour that afternoon. Forty-eight hours later, the listing agent called: an offer had already come in. Rognerud and her husband scrambled to come up with a competing offer for $1.6 million within an hour — and ended up beating out the other buyers.

“We had to be super diligent in finding a home,” she said.

Though rates were close to 7% when they bought, they figured it was better to act sooner rather than later.

Related Articles

Marin median house price dips to $1.6 million and sales rise

Going to an open house? Now you might have to fill out a form, per new homebuying rules

The rules for homebuyers and sellers are changing in California. Here’s what you need to know.

How will homebuying’s commission mess end? Wall Street offers a clue

Bill would limit California homebuyer contracts to 3 months

“Once rates come down — and we’re pretty confident they will — home prices will just go up,” Rognerud said.

It remains to be seen whether new rules around real estate agents’ commissions — buyers can no longer take it for granted that sellers will take care of their agents’ fees — will have an impact on the market. The changes went into effect just last week, and aren’t reflected in the July data.

“We were predicting a busy fall,” said David Stark, spokesperson for the Bay East Association of Realtors. “So we’re going to be finding out here sooner rather than later exactly what these changes mean.”