Your holiday shopping budget should contain a generous helping of “food-flation” in the mix.

With significant dining expenses coming this festive season, my trusty spreadsheet peeked at high food prices crimping household budgets. By melding government pricing stats from four big California regions – Los Angeles/Orange County, the Bay Area, the Inland Empire and San Diego – we get a rough yardstick of food costs and their sharp swing higher in recent years.

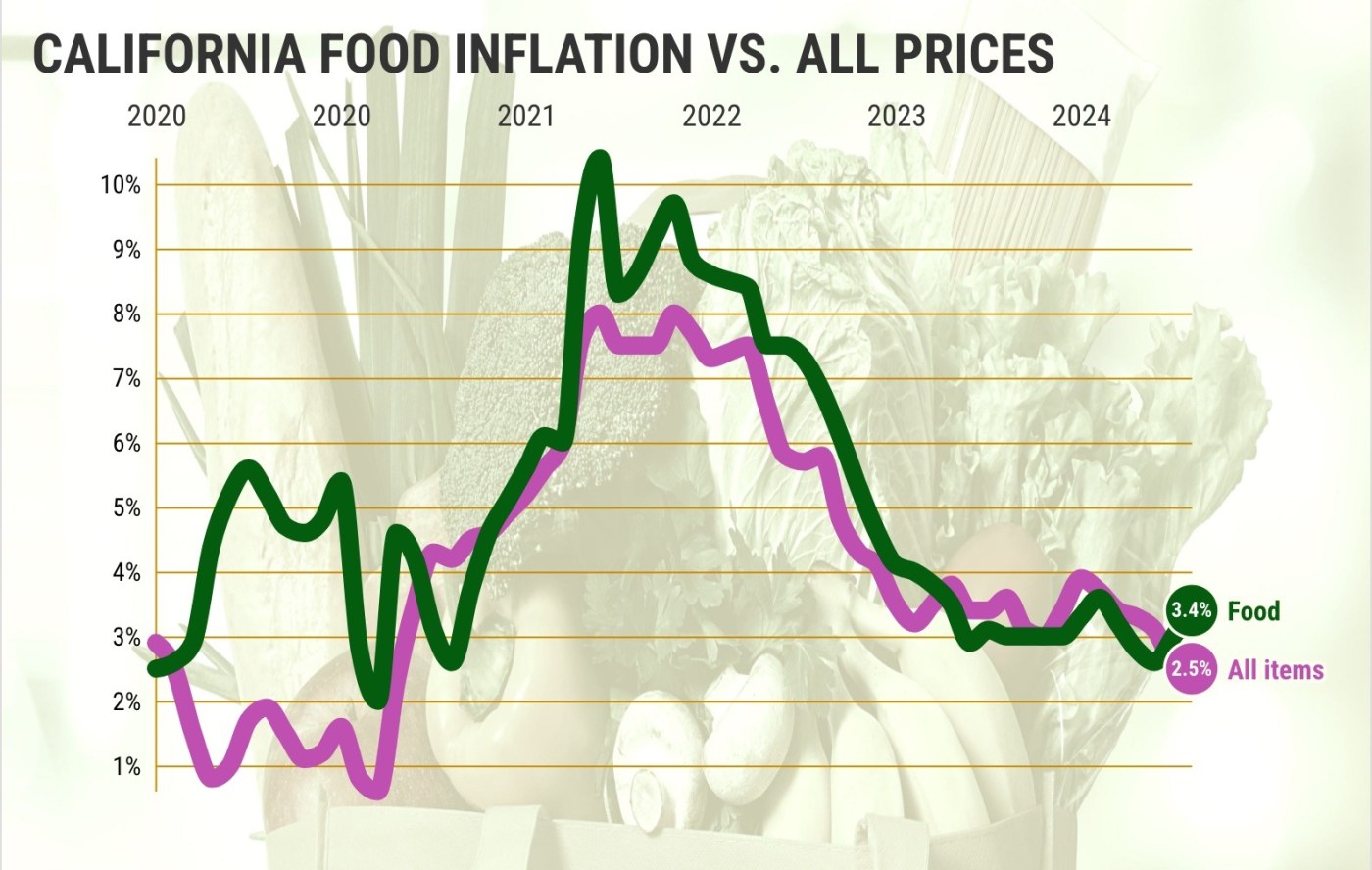

The typical Californian’s total food and beverage costs rose 3.4% in the year ending in October, according to my combined Consumer Price indexes.

Yes, food-flation has slowed. This benchmark’s most recent peak was in February 2022, when various coronavirus contortions helped push food and beverage prices up 10% in a year.

Yet, this statistical dip doesn’t dull the compounding smack to our savings. California food is 27% costlier than five years ago, according to CPI figures.

Now, when household finances are tight, we might skip entertainment or vacations – or even holiday gifts. We’ll wear old clothes, drive a clunker or even consider do-it-yourself tasks instead of hiring somebody.

Buying food can’t be avoided. Problematically, California’s food-flation is worse than the rise of the overall cost of living.

California costs for all goods and services rose 2.5% in the past year, as tracked by my CPI math. Again, the latest jump is below the last peak, when overall inflation grew at an 8%-a-year pace in June 2022.

However, many financial anxieties are tied to the longer-term wallop: Golden State consumers pay 21% more across the board since 2019.

In or out

Where you choose to eat alters how you feel about food-flation.

Contemplate California food costs by this split – groceries vs. dining out.

At the market, food prices are up 1.1% yearly vs. peak inflation of 13% in July 2022. Still, the grocery bill is 28% bigger in five years.

That injury to your wallet is modest compared to “food away from home” costs.

A visit to a California restaurant got 6.4% pricier in the past year – an inflation surge that’s not terribly off the 9.7% peak of February 2022. And my CPI analysis tells us eating out has become 30% costlier over five years.

Why? Restaurant owners have faced numerous challenges, from pricier supplies, costlier operations, and higher wages for employees – if those workers can be found.

Pick your poison

When grocery shopping, inflation varies by the aisle.

Just about every expense involved in producing food and transporting it to the market has surged – from labor to energy to materials. Magnifying those headaches are shortages created by everything from pests to war.

So ponder the differing cost swings in food categories tracked by regional CPIs, ranked by their California inflation in the past year.

Meats, poultry, fish, and eggs: Up 2.3% yearly and 24% in five years. This inflation rate’s monthly peak was 14% in May 2022.

Fruits and vegetables: Up 2.1% yearly and up 13% in five years. High? 11% in April 2022.

Sweets, snacks, oils, frozen foods: Up 1% yearly and 30% in five years. High? 15% in July 2022.

Cereals and baked goods: Off 0.4% yearly but up 29% in five years. High? 13% in May 2022.

Nonalcoholic drinks: Off 0.1% yearly but up 15% in five years. High? 8.8% in January 2022.

Dairy products: Off 1.6% yearly but up 15% in five years. High? 11% in November 2022.

Bottom line

Ponder one last CPI food niche – what’s arguably California’s food-flation bargain.

In a season that calls for celebration, prices are tumbling for alcoholic beverages. Costs are down 13% in a year for name-your-poison: booze, beer or burgundy?

Yes, alcohol is still 15% pricier than five years ago. But these drinks are in a steep reverse, with prices down from peak inflation of 17% in September 2023.

So, cheers to a dash of good inflation news!

Postscript

Rising labor costs are a significant chunk of food-flation – especially dining out.

At the same time, widespread pay hikes across California counter some of inflation’s pain.

The statewide average weekly wages grew by 31% in the five years ended in March, according to a federal pay gauge. That beat food-flation’s 27% surge since 2019.

Well, just like food costs haven’t moved in sync across spending categories, wage growth isn’t uniform.

For example, the 33% wage hikes over 5 years handed out in California’s service industries beat food-flation. Goods producers didn’t keep pace, though, up only 26%.

Three key industries also trailed – natural resources wages rose 18%, education and health services were up 23%, and construction increased 23%.

And geographically speaking, raises in 23 of California’s 58 counties did not top food-flation.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Related Articles

‘Difference is Trump’: American homebuyers brace for rate pain

Want to comment on plans to raise Bay Area bridge tolls? A chance is Wednesday morning

Higher monthly payments loom for many student loan borrowers

Future of Medicare drug price negotiations murky under Donald Trump

Amazon launches online discount storefront to compete with Shein and Temu, kills Freevee channel