Serenity at Larkspur is, in many ways, your standard luxury apartment complex. Perched on the golden hills of Marin County, it offers views of the San Francisco Bay and Mount Tamalpais. Residents have access to a long list of amenities, including two pools, a tennis court and a wine tasting room. At the high-end Marin Country Mart across the street, they’ll find designer brands such as Goop and Design Within Reach.

Rent isn’t cheap. A one-bedroom goes for $3,004 — high but in line with the market.

Except Serenity at Larkspur isn’t supposed to be a market-rate apartment building. In 2019, it was acquired by Catalyst Housing, a developer that received a tax break from the city of Larkspur in return for what it described as affordable housing, setting rents at levels that low- and moderate-income renters could afford.

The deal came together via an obscure government agency that Catalyst helped create, the California Community Housing Agency, also known as CalCHA, which issued tax-exempt municipal bonds on behalf of Catalyst to finance the $226.5 million deal. The city agreed to exempt Serenity from property taxes, about $2.4 million each year, and in return Catalyst converted the apartments into what it calls “essential housing” — agreeing to cap rents at levels affordable to those making 80% to 120% of the area median income, or about $109,680 to $164,520 for a single person.

Since 2019, private developers such as Catalyst have used CalCHA’s bond-issuing powers to buy 13 luxury properties around the Bay Area and more in Southern California. Cities from Berkeley to Antioch enthusiastically signed on to the CalCHA program, forfeiting a collective $21 million in annual property taxes.

But rental discounts have been minimal and sometimes nonexistent. A Bay Area News Group analysis of public CalCHA financial documents and rental data for market-rate properties found that nearly half of the CalCHA “essential housing” units in the Bay Area charge higher per-square-foot rates than their market-rate counterparts.

“This program does very little to make housing more affordable for middle-income households and in some cases costs them more in rent than comparable market-rate housing,” said Matt Schwartz, president of the California Housing Partnership, an affordable housing advocate.

The program has been a financial bonanza for Catalyst, which owns 10 of the Bay Area properties, and other private developers — which together have collected $25 million in upfront fees from the acquisitions and stand to make millions more in interest payments over the 30- to 40-year lifetime of the bonds. Another $48 million in fees has gone to the bankers and law firms that issued the bonds. What’s more, the millions in interest collected by the bond’s investors are exempt from state and federal income taxes, which in California can be as much as 50% for high earners.

“This looks to me like a public to private sector wealth transfer,” said Lisa Washburn, managing director of Municipal Market Analytics, an independent research- and data-provider that analyzes the public finance industry. “The governments gave up property taxes for an important public purpose, but much of the benefit accrued to those involved in the transaction.”

A new housing model

As California’s housing costs have come to weigh on all but the most wealthy, policymakers have become increasingly concerned about rising rents among middle-income households, a class of renters not eligible for traditional affordable-housing subsidies.

Jordan Moss, Catalyst’s founder and a former multifamily broker with CBRE, had a solution.

“There’s a whole host of people in California who generally earn too much to qualify for more traditional Capital-A affordable housing but not enough to live directly within the communities that they serve,” Moss told a real estate podcast in 2021. (He declined an on-the-record interview with the Bay Area News Group and did not make anyone else from Catalyst available for comment.)

The “traditional model” for building affordable housing, highly competitive public subsidies and tax credit financing, Moss said, “wasn’t scalable.”

Instead, Moss turned to a financing tool that has long been used by counties and school districts to fund major infrastructure projects — municipal bonds. Jurisdictions sell these IOUs to investors and repay them with interest using tax revenue or user fees.

In California, jurisdictions can also band together to create what is known as a joint powers authority, or a JPA, which has the power to issue bonds. Also referred to as “conduit issuers,” these authorities sell bonds on behalf of private companies or nonprofits, which use the proceeds toward a project that is supposed to have a public benefit and pay them back with the project’s revenues.

Moss worked alongside a group of bankers, consultants and attorneys to create their own JPA. The group approached Kings County, population 152,682, in the San Joaquin Valley. In 2019, local officials there agreed to create a new conduit issuer to sell bonds, CalCHA.

Technically, the Kings County Board of Supervisors governs CalCHA, but, in reality, it exercises little supervision. The board’s four meetings this year have run as long as 17 minutes, though they typically clock out at three. CalCHA effectively functions as a shell company, with operations contracted to a Walnut Creek-based company, GPM Municipal Advisors, run by two municipal bond pros, Michael LaPierre and Scott Carper. They have worked for two other California “conduit issuers” with their own versions of the “essential housing” program. LaPierre and Carper did not respond to requests for comment. Neither did any member of the Kings County Board of Supervisors.

For Catalyst and other project sponsors, access to CalCHA financing meant they didn’t need to bring any of their own money to the table. In typical real estate acquisitions, investors contribute around 30% of the equity and enlist a bank to finance the remaining 70%.

With no real limitations on how much it could raise, CalCHA began issuing bonds for its “essential housing” acquisitions. The bonds covered much more than just the purchase price of the property. They also provided additional leverage, as much as 20% of the project’s total value, to stock their reserves and pay the deal’s fees.

For just one deal, Serenity, Catalyst received an upfront fee of $2.2 million plus a yearly fee of $205,200 for acting as the project administrator. CalCHA and its administrators collect a yearly fee of $214,775. The bankers and lawyers on the deal collected one-time fees worth $4.9 million for consulting and handling the paperwork.

On top of that, Catalyst also granted itself $6.7 million in subordinate bonds, which pay out 10% in annual interest over the bonds’ 35-year lifetime — a total of $24 million in payments.

Cities rarely see these financial details in Catalyst’s pitch decks. Instead, Moss and his colleagues have focused on the public benefits written into the regulatory agreement — the “affordable rents” plus the fact cities stand to become the beneficial owner of the property. CalCHA also gives cities the option to buy the properties after 15 years after any outstanding debt is paid off.

“On a long-term basis, all of the financial upside of these assets is gifted to the underlying municipality,” Moss said on the podcast.

So what affordability has the “essential-housing” program created?

In an email, Moss said that Catalyst’s “essential-housing” renters currently receive an average 23% discount compared to current market rents. When asked to provide analysis or data backing up that claim, he declined to provide any details.

In its own analysis, the Bay Area News Group found that the one-bedroom and two-bedroom units at the lowest-income tier rented at an average discount of 6% to market rates. But at the highest-income level, “essential-housing” rents were 4.5% higher than market rates. The Bay Area News Group shared its analysis with CalCHA and Catalyst, but they did not respond on the record to the findings.

It’s possible that “essential housing” rent discounts might have been more significant if market rents had grown as quickly as they did before the pandemic, an average of 3.8% each year between 2015 and 2019. But during COVID, market rates dipped across the Bay Area and have recovered at a slower rate.

There are other reasons “essential-housing” rents are so high. CalCHA doesn’t follow the standard guidelines set by the U.S. Department of Housing and Urban Development to set rates for affordable units at no more than 30% of a tenant’s annual monthly income. Instead, the agency caps rents at 35% to 40% of monthly income, depending on the property.

Affordable for whom?

Few tenants interviewed by the Bay Area News Group at Serenity in Larkspur and Creekwood, a 309-unit luxury apartment complex in Hayward managed by Catalyst, described their living situation as affordable.

Angelica Cardenas, a 38-year-old preschool director, moved into Creekwood last year with her two children. With a salary of $108,000, she qualified for a $3,000-a-month two-bedroom apartment.

“More than half of my take-home pay goes to rent,” Cardenas said. “I don’t feel like it’s affordable. They make it seem that way when you come in, but it’s not.”

She’s already on her way out. At the end of the month, she plans to move into her mom’s place down the street, hoping to save up for a down payment.

Her neighbor, Victor Khan, 34, works in IT at a Hayward school and qualified for a studio apartment at the Creekwood Apartments, paying $2,000 a month plus $110 for garbage, sewer and water.

He likes the apartment for its safety and relative walkability — the Hayward Japanese Gardens are next door, plus he’s within blocks of restaurants — but he wouldn’t say he’s getting a big discount on rent.

No longer able to afford rent at Creekwood Apartments in Hayward, Calif., Angelica Cardenas packs her belongings before moving, Thursday, Nov. 21, 2024. (Karl Mondon/Bay Area News Group)

“I have friends in San Francisco, and they’re paying comparable to what I’m paying,” he said.

At Serenity, some residents can only afford the “essential housing” rent because they got additional discounts. Moss himself chipped in $100,000 of Catalyst’s corporate profits to form a nonprofit, The Essential Housing Fund, that provides an extra rent subsidy specifically for local teachers and provides $1,000 toward their moving costs.

Other renters say they only signed a lease because they received major concessions that reduced the rent beyond the restricted rates.

Edgar Leyva said Serenity offered him a $12,500 first-year credit on his apartment, which allowed him to reduce the monthly payments on his one-bedroom from about $3,000 to $2,400. But his lease ends this winter, and he’ll be bumped back up to the higher rate.

“There aren’t many options in Larkspur,” said Leyva, who makes around $120,000 as a software engineer. “But I’ll probably start looking for other places when my rent goes to $3,000.”

If Leyva were to stay, Serenity could only increase his base rent by 4%, the maximum amount allowed by the regulatory agreement for the “essential housing” properties. CalCHA’s supporters say that the rental stability it offers is especially valuable in areas where rent grows quickly. California statewide rent control laws only limit rent increases to 10%.

“There is value in taking existing market rate property, restricting it and making it more affordable,” said Linda Mandolini, a board member for Catalyst Housing and president at Eden Housing. “Companies that do this ‘missing-middle’ housing are holding the line on rent.”

Mira Vista Hills apartment complex on Nov. 12, 2024, in Antioch, Calif. The property is owned by the California Community Housing Agency. (Aric Crabb/Bay Area News Group)

Financial distress

But the huge amounts of debt that facilitated these deals could be their undoing. Several CalCHA projects are in financial distress, which could threaten their affordability.

As is common for municipal bond issuers, CalCHA stocked each project’s reserves with issued money to meet the first few years of interest payments. A few years in, those reserves are dwindling, and some of the properties aren’t generating enough rental income to cover their debt service. In recent months, Serenity at Larkspur, Annadel in Santa Rosa and Twin Creeks and Mira Vista Hills in Antioch all reported in public disclosures that they have less cash than what their investors required them to keep on hand. Catalyst blames its financial woes on inflation and pandemic-era financial challenges, not its financing structure.

Related Articles

Santa Clara approves massive Mission Point development that includes 2,600 new homes

Bay Area home sales rebound in October after mortgage rates drop to two-year low

California affordability fixes: 3.5% loans, 50% raises, or 33% home-price cuts?

Morgan Hill welcomes 73 units of affordable housing to help farmworkers, homeless residents

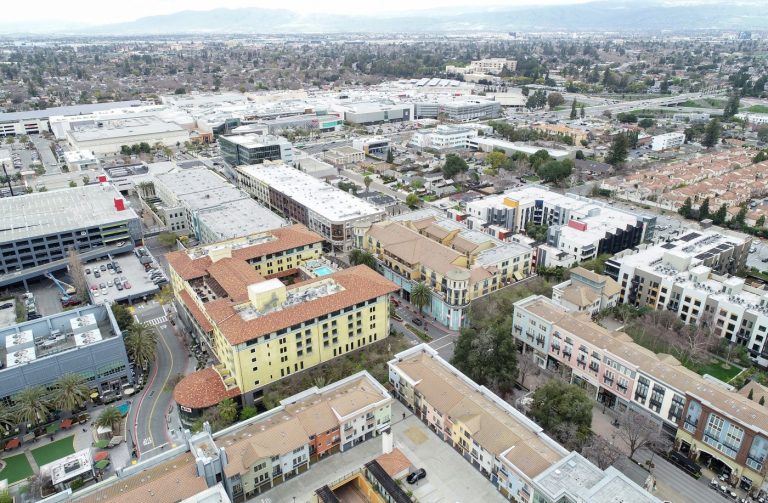

Big housing development with several hundred units is eyed in San Jose

Bondholders, including San Mateo-headquartered Franklin Templeton, are currently in negotiations with CalCHA over a possible recapitalization plan for Serenity. Under that plan, CalCHA would issue $248 million in new bonds to replace the $220 million in outstanding bonds, re-stock their reserves and pay more fees.

How to pay for all that new debt? Serenity would need to make more money. Public disclosures show that CalCHA and Catalyst are considering renovating some of Serenity’s units so they can charge higher rent, then “temporarily” opening up leasing to people making over 120% of area median income. Cities like Larkspur won’t get any say in how those negotiations shake out — the regulatory agreement governing the affordability restrictions is between CalCHA and its bondholders.

As part of the refinancing, Catalyst would waive its administrative fee for the first six years, losing out on $1.2 million. But it could work out for the company in the end. The refinancing would grant Catalyst an additional $2.3 million in subordinate bonds for a total of $9 million. If the rosy revenue projections at Serenity bear out and the property meets its debt obligations, that subordinate debt would pay out $31 million to Catalyst in the next 35 years — $7 million more than it’s set to make today.

How we did this analysis:

Catalyst CEO Jordan Moss has said that his company measures its impact by comparing actual restricted rents for income-qualifying households to the current market rents that these residents would otherwise face. So we did our own analysis of rents at comparable properties.

Catalyst and other private developers commissioned appraisals for every property they acquired with CalCHA financing. These are publicly available on Electronic Municipal Market Access, also known as EMMA. Each of the CalCHA appraisals identified four to seven comparable properties in the Bay Area.

For each comparable apartment building, the Bay Area News Group searched on Zillow and Apartments.com between Nov. 12 and Nov. 14 for any units on the market. We then calculated the average per-square-foot rent charged by each of the properties for each unit type, then averaged those to create a market rate comparable set average. To find the discount offered by a CalCHA property, we calculated the difference between the comparable set per-square-foot average rent charged and the “essential housing” per-square-foot rent.