A group of Tiburon residents is battling to reclaim a property that Marin County mistakenly sold at a tax auction.

The buyer, a limited liability company called AssetRenew, scooped up the parcel for $6,600. Now the company wants the Tiburon View Homeowners Association to pay $1 million to get it back, or pay rent to use it.

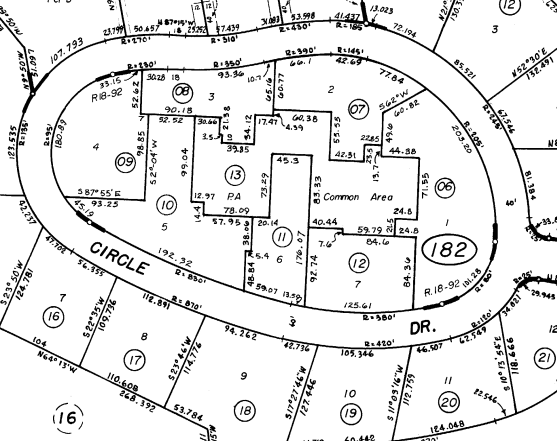

The parcel is a common area that includes a pool, a recreation area and laundry facilities for seven association members living on lots surrounding the Circle Drive property. The county sold it at a public auction in March because the association owed $625 in unpaid taxes and $981 in penalties for the years 2013-2018.

“We recognize that this was erroneous and it needs to be rescinded,” said Sandra Kacharos, the county’s assistant director of finance. “We have asked the purchaser to voluntarily rescind, which is the first step in the legal procedure. However, they have indicated that’s not their intent.”

A phone call to AssetRenew elicited this reply from a person who offered no identification: “I have no response. I’m not allowed to talk about it.”

In a letter to the county, the association’s attorney, Richard Zuromski, wrote, “The principal Derek Leffers of Aptos, California, specializes in purchasing properties at tax sales to take advantage of situations like the one at hand.”

“Indeed, since purchasing the common area parcel, the purchaser through Mr. Leffers has demanded payment of over $1 million for the common area parcel,” Zuromski wrote.

In his email, Zuromski said AssetRenew has “held the association hostage for ‘rent’ for the common area parcel when the CC&Rs clearly indicate that the association and its members have an easement over the common area parcel as part of their ownership in the lots.”

He wrote that Leffers “has threatened to ‘evict’ the association from the common area parcel should his demands not be met.”

In an unsigned letter to county supervisors, AssetRenew wrote, “We feel that the Tiburon View Homeowners Association letter was misleading and untruthful in some areas.”

The letter stated that AssetRenew had received “multiple other offers” for the property and that the association “could buy the property back on the open market if they wanted to.”

“We are having to take on significant expenses dealing with this,” the letter said, “and are reaching out to the Board to understand this process.”

It wasn’t delinquent county property taxes that triggered the sale.

“The common area is assigned an assessed value of $1 because the real value of that area is distributed among the individual lot owners,” Kacharos said.

However, because the common area was assigned an assessor parcel number, 034-182-13, to identify it, other taxing agencies authorized by ballot measures and other regulations submitted direct charges. Direct charges may be collected by the county tax collector on behalf of a taxing agency at the same time as other county property taxes.

The Belvedere Tiburon Library, the Marin Emergency Radio Authority and the San Francisco Bay Restoration Authority all submitted modest direct charges to the tax collector for the common area to pay.

According to Zuromski, the tax bill for the common area was sent initially to the association’s manager, Bayside Management and Leasing, which paid it along with the tax bills for the other seven association members.

Bayside Management moved its office from Mill Valley to Sausalito in 2010, and the company submitted a change-of-address notification to the U.S. Postal Service, Zuromski wrote.

“For reasons unknown to the association, the tax bill for the common area parcel was not forwarded to Bayside’s new address,” he wrote.

Kacharos said that under state law, a U.S. Postal Service notification does not change an address for tax purposes. The owner of record must submit a change of address to the county assessor.

Related Articles

From California to New York, cities cut red tape to turn unused office buildings into housing

300-plus unit San Jose housing tower could help fuel downtown revival

Capital Club shutdown jolts San Jose businesses, creates opportunities

Capital Club closes in San Jose but tech firm takes over highrise spot

Mountain View center lands new movie theater, restaurants, stores

Zuromski also questions whether the tax collector properly noticed the association of the tax sale. State law requires the tax collector to “send notice of the proposed sale by certified mail with return receipt requested to the last known mailing address, if available, of parties of interest” and to “make a reasonable effort to obtain the name and last known mailing address of parties of interest,” he wrote in his letter.

“At no time did the association, any of its members or the management company ever receive notice of this tax sale,” he wrote.

The county has determined that the tax sale deprived the Tiburon View Homeowners Association of due process and violated a state law that prohibits common areas from being the sole subject of a lien for property taxes. As a result, the sale was invalid and must be rescinded, the county concluded.

County supervisors approved the rescission on Nov. 5. Kacharos, however, said that approval was conditioned on AssetRenew’s cooperation. She said that since AssetRenew has refused to endorse the sale rescission, the next step will be to bring the matter to the Board of Supervisors for a hearing. That has not yet been scheduled.

The county tax collector is required to offer tax-defaulted property for sale when the age of the default exceeds five years. From fiscal years 2017-18 to 2023-24, 51 Marin properties were sold in tax sales.

Kacharos said that when conducting tax sales, her department focuses its attention on properties that have residences on them and does its best to help owners keep their homes. The tax sale during which the Tiburon common area was sold involved 109 properties, including seven residences. No bids were received on 89 of the parcels, and 10 vacant parcels were sold.

“We saved all of the residences,” Kacharos said.

The tax collector is reappraising how common areas on the property tax rolls are handled to prevent similar errors.