OAKLAND — A likely special election next spring has placed Oakland in a time crunch — not just to find a mayor and fill a City Council vacancy but also to secure new revenue streams that could help address a historic local recession.

Next Tuesday, the council will consider going to voters for a parcel tax to financially support the independent oversight bodies that keep a5en eye on the Oakland Police Department and watch for potential ethical violations by public officials.

A separate sales tax under consideration would funnel revenue into the city’s general purpose fund, which mostly pays for salaries and daily operations. The fund is also the epicenter of the city’s present financial crisis, with projections placing it at a $130 million deficit by next summer.

Officials are still ironing out details of the two tax measures before deciding whether to put them on the April 15 special election ballot, which otherwise is intended to fill vacancies in the city’s leadership after and to the Alameda County Board of Supervisors.

Mayor Sheng Thao was recalledCouncilmember Nikki Fortunato Bas electedBut the council may need to move quickly next Tuesday. A subsequent meeting in January — the first held by a new council lineup — will be the final opportunity for a majority of the council to place the measures on the April ballot.

City leaders will also be tasked with convincing a historically tax-friendly voting base that an increased burden is worth it; the sales tax would be passed down to customers at a time when the city’s businesses are struggling to stay afloat.

“I want to consider the potential ramifications of the budget deficit,” Councilmember Carroll Fife said at a meeting Thursday, “but also how taxpayers are feeling the implications of (it) — and a host of other things that make me deeply concerned about moving this (tax measure) forward.”

The sales tax in Alameda County, at 10.25%, is already the highest of any county in California and three percentage points above the statewide rate. Over a half-dozen cities in the county go even higher, per state data, but Oakland does not have its own local sales tax.

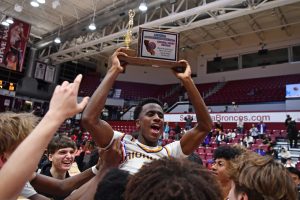

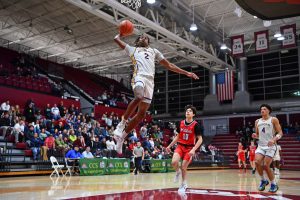

District 6 city council candidate Kevin Jenkins is greeted at mayoral candidate Loren Taylor’s election night party at For the Culture in downtown Oakland, Calif., on Tuesday, Nov. 8, 2022. Jenkins helped introduce an ordinance for a new sales tax proposal that the City Council will consider next week. (Jane Tyska/Bay Area News Group)

Meanwhile, property owners pay roughly $1,109 a year in taxes for land parcels they own, including to fund , and violence prevention.