High interest rates and increasing construction costs had already put a strain on efforts to increase the Bay Area’s inadequate housing supply. Now, as President Donald Trump places sweeping tariffs on imports from China, Canada and Mexico, building costs and home prices are expected to increase even further.

Trump’s changing timeline for introducing new tariffs has made it difficult for homebuilders to anticipate what duties will actually go into effect, and when. Here are the tariffs the president has announced so far:

— Mexico and Canada: On Feb. 1, Trump announced tariffs of 25% on these two major U.S. trading partners that would go into effect in March. Just two days later, he paused the tariffs for 30 days after Mexico and Canada pledged to curb drug flows across their borders. The tariffs went into effect March 4.

— China: On Feb. 1, Trump announced a 10% tariff applied to Chinese imports, effective on Feb. 4. China will be charged an additional 10% tariff beginning on March 4, bringing the total duty to 20%.

— Steel: On Feb. 10, Trump ordered a 25% tariff on steel and aluminum imports from all countries set to take effect March 12.

— Lumber: On Feb. 19, Trump also floated the idea of a 25% tariff on international forest and lumber products to take effect around April 2. This tariff hasn’t been officially announced. (Canada, which is the largest foreign supplier of softwood lumber to the US, is already under tariffs totaling 14.5%, as of August 2024. Additional tariffs would increase the total duty to 39.5%.)

On the campaign trail, Trump said he would use tariffs to raise tax revenue and bolster domestic production of resources critical to national security.

But the combination of duties could complicate Trump’s campaign promise to lower the cost of housing by increasing supply. Amid the confusion around tariffs, homebuilder confidence fell in February to its lowest level in five months, according to the National Association of Home Builders.

Builders say tariffs will increase costs, but it’s hard to put a finger on exactly how much. That’s because there are so many variables when it comes to measuring the impact of tariffs. Large homebuilders, for example, might start buying lumber now to get ahead of the new duties. Developers might source appliances from domestic manufacturers rather than Chinese ones. Borrowing costs could increase as lenders anticipate more volatile pricing.

The following charts show how consumers might feel the impact of the tariffs on their housing, rental and renovation costs.

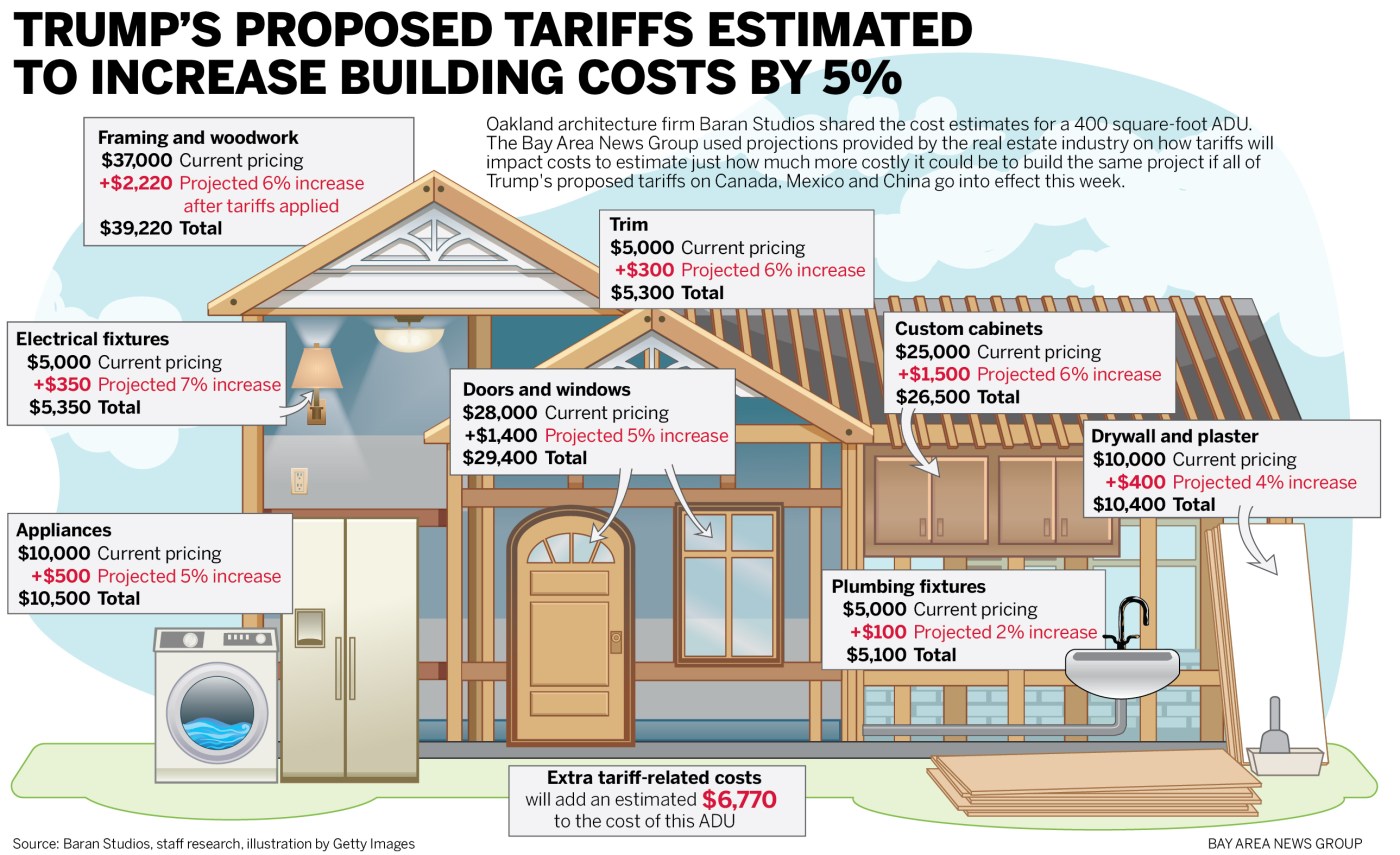

One estimate suggests building costs are set to go up around 5%.

A report from the real estate research firm John Burns Real Estate Consulting (JBREC) anticipates that costs of building materials are set to increase by 5%.

To find that number, the company looked at different building elements, and just how much of the U.S. supply comes from Canada, China and Mexico. It then calculated the average tariff rate for those products, and multiplied the average tariff rate by the share of the U.S. supply to estimate how much the cost of each might rise.

What does that look like in terms of dollars?

The Bay Area News Group asked a few builders for cost estimates for recent projects. We used the JBREC estimates to project how much costs would increase under Trump’s proposed tariffs to Mexico, Canada and China.

This analysis doesn’t look at every building product — just the six studied by JBREC — so it is likely an underestimate of how costs will increase.

It’s also important to keep in perspective how much materials factor into a home’s total cost.

In the Bay Area, for an average home, the most expensive component is the land.

For a typical single-family home in the region, the land accounts for about two-thirds of the price, according to a 2024 study by the Federal Housing Finance Agency.

High land values are driving Bay Area developers to build more densely. By building multiple homes on one lot, the initial land cost is spread across multiple units, so land makes up a smaller portion of the overall value of each unit.

That means that urban multifamily developers around the Bay Area are going to feel the burden of tariffs more than single-family home developers on the outskirts of the region, since materials represent a larger part of the overall budget.

But just how much?

Consider one study by the Terner Center for Housing Innovation at UC Berkeley, which used surveys of developers to estimate the costs of a typical wood-frame, mid-rise 120-unit apartment building. In Oakland, for example, the land is $8 million — about 10% of the overall costs. About $50 million, or 60% of the project’s costs, are the hard costs, which include labor and construction.

Of that $50 million in hard costs, it’s difficult to estimate how much of that is labor and how much are the materials themselves. Generally, 40% to 50% of hard costs correspond to labor — but that number varies by region. California, and San Francisco specifically, have some of the highest labor costs in the country, according to a study by the economist and demographer Issi Romem.

Assuming labor costs account for half of hard costs, then material costs would be $25 million. If tariffs increase the total cost of building materials by 5% overall, that would add $1.25 million to the entire project, for a total cost of $82.05 million.

Related Articles

Mexico to impose retaliatory tariffs on US following China and Canada as trade war heats up

Wall Street’s losing streak deepens as Trump’s tariffs kick in

‘No room’ for delay: Trump says 25% tariffs on Mexican and Canadian imports will start Tuesday

Letters: We must lead nation from Donald Trump’s darkness

EU pushes back hard against Trump tariff threats and his caustic comments that bloc is out to get US

Overall, the project’s budget would grow by 1.5% from the original $80.8 million.

But those added costs might end up pushing a project beyond the point of viability.

A developer can’t just demand higher rents to make up for the higher costs — the market sets the rents, not the developer. Put another way: If a renter isn’t willing to pay what a developer is asking, the unit won’t rent. And if a developer thinks she’s going to lose money, she won’t build.

That lack of supply is what will end up driving rent prices higher, housing experts say. It’s more of a secondary effect of tariffs, rather than the tariffs themselves.

Many developers, though, say the biggest barrier to building is something else entirely.

“Tariffs are not as much of an issue for the housing industry as the Federal Reserve’s reluctance to lower the interest rates,” said Andy Ball, president of oWOW, which is finishing construction on a mass-timber building in downtown Oakland and has a second project in the works.

The pandemic building boom, fueled by near-zero interest rates, came to a rapid end in 2022 as rates climbed to a peak of 5.33% in August 2023. Though rates have since fallen to 4.3%, they remain near the highest levels they’ve been in two decades — still too high for most Bay Area developers to start new projects.

If and when interest rates fall and make financing cheaper, that’s when the Bay Area might see the larger impact of tariffs on the housing supply.