“How expensive?” tracks measurements of California’s totally unaffordable housing market.

The pain: Tenants will find dwindling cost advantages when choosing California’s cheapest places to rent compared with the state’s priciest spots.

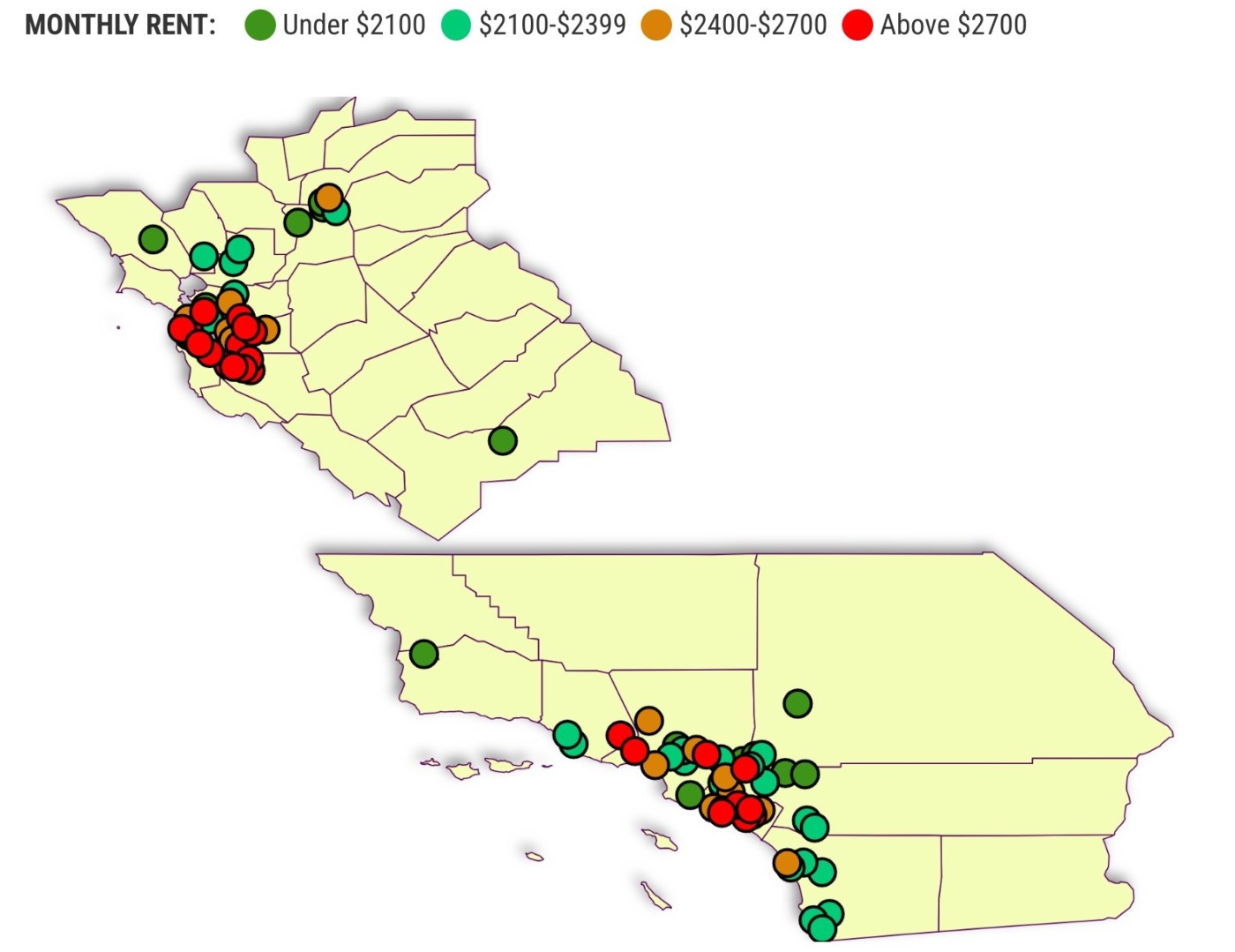

The source: My trusty spreadsheet reviewed Apartment List’s rent data between January 2017 and March 2024. It’s an interesting metric because it’s a mix of Census Bureau figures and results from the company’s own rental listings for 47 states, the District of Columbia, and 583 US cities – including 82 in California. (Yes, no Alaska, Maine or Vermont).

The pinch

My spreadsheet created a rent “bargain” yardstick by splitting the 82 California cities into two groups.

For high-priced rents, we looked at what stat geeks call the “75th percentile” – the middle price of the 41 cities ranking in the upper half of rents statewide. That cost was compared with low-rent districts: the “25th percentile” – which is the middle rent for the cheapest 41 cities. (FYI: The often-used median is the 50th percentile.)

Back in 2017, there were 36% in rent savings between these measurements of California’s costliest and most inexpensive markets. That was $2,471 monthly rent in the upper half vs. $1,589 at the lower end. Or $882 potential savings each month between renting in a typical pricey California city vs. an “affordable” town.

Related Articles

Milpitas pilots new rental assistance program for low-income locals

Milpitas moves forward with rental assistance program

San Jose adopts ‘anti-gentrification’ policy to set aside affordable apartments for locals

This Bay Area city could be the next to see rent control on the November ballot

The feds want to study giving cash to renters. Will Californians be included?

Next, we looked at today’s conditions – data for the 12 months ended in March 2024. The housing discount for renting in the Golden State’s less-costly communities fell to 22%. That was $2,748 in the most-expensive cities vs. $2,144 in cheaper ones. Or $604 monthly.

Or ponder the shrinking savings this way: Rents in California’s costliest half grew just 11% since 2017. But there was a 35% surge in the more “affordable” locales.

Why the narrowing gap? You can blame a population push away from the biggest metropolitan areas, mostly near the ocean, and toward lower-cost communities that are primarily inland. That’s the byproduct of remote workers departing job hubs and folks seeking cheaper housing.

Pressure points

Sadly, rent “bargains” in California – relatively speaking – are disappearing.

Think about California’s 10 “most affordable” communities and the hefty rent hikes found since 2017 …

Fresno: $1,327 average rent in the 12 months ended in March – up 42% vs. the 2017 average.

Victorville: $1,641 – no change data available.

Citrus Heights: $1,659 – up 38% since 2017.

Sacramento: $1,667 – up 30% since 2017.

Santa Maria: $1,761 – up 52% since 2017.

Long Beach: $1,769 – up 19% since 2017.

Riverside: $1,810 – up 48% since 2017.

Pomona: $1,865 – up 31% since 2017.

Santa Rosa: $1,903 – up 18% since 2017.

Moreno Valley: $1,906 – up 48% since 2017.

Contrast those surges to what’s occurred in the state’s 10 costliest places to rent …

Calabasas: $3,302 a month – up 27% since 2017.

Newport Beach: $3,259 – up 27% since 2017.

Lake Forest: $3,169 – up 42% since 2017.

San Mateo: $3,137 – up 6% since 2017.

Dublin: $3,131 – up 6% since 2017.

Emeryville: $3,032 – off 4% since 2017.

Sunnyvale: $3,019 – up 7% since 2017.

Irvine: $2,983 – up 29% since 2017.

Redwood City: $2,980 – up 2% since 2017.

Santa Clara: $2,979 – up 16% since 2017.

Bottom line

California tenants also don’t fare well within the national picture.

The state’s $2,154 average rent in the 12 months ending in March was topped only by Hawaii’s $2,239. Rent nationwide ran $1,402 a month, by this math. That’s 35% cheaper.

But let me conclude with a dash of good news: California’s overall rents rose by 21% since 2017 vs. US rents that jumped 28% in the same period.

Only six places had smaller rent hikes since 2017 – DC at 5%, Louisiana at 11%, Minnesota at 14%, Iowa at 15%, Oregon at 16%, and North Dakota 17%.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com