The “Looking Glass” ponders economic and real estate trends through two distinct lenses: the optimist’s “glass half-full” and the pessimist’s “glass half-empty.”

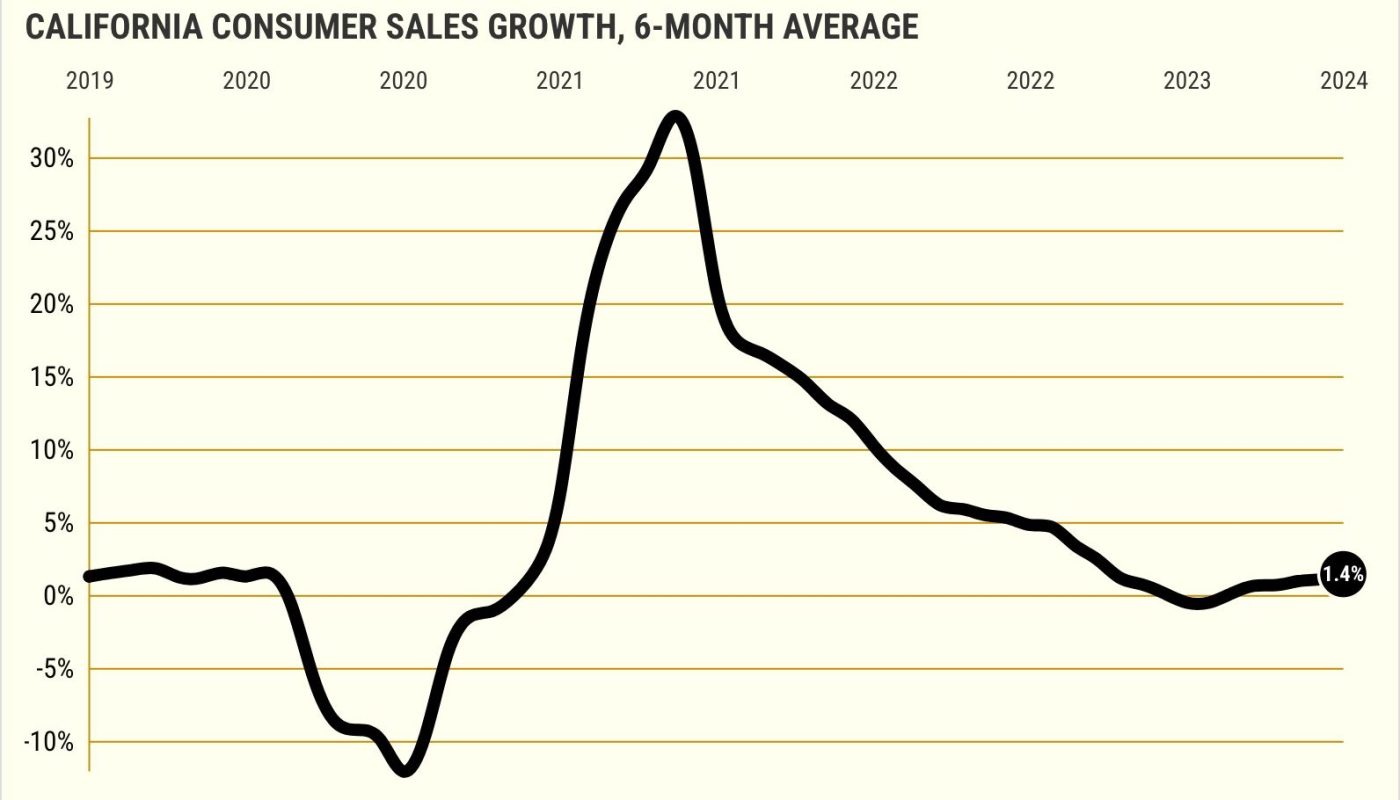

Buzz: Cash registers at California merchants were ringing more frequently in early 2024.

Source: My trust’s spreadsheet’s look at California retail sales, minus online shopping, as measured by the Census Bureau.

Debate: Sales averaged 1.4% annual growth in the six months ended in February. That’s a reversal from a shopping decline at a 0.5% annual rate in the previous half-year.

Glass half-full

So where were Californians actively shopping?

Some pandemic shopping hot spots remain popular. Health goods and personal care stores’ sales rose at a 6.7% annual rate through February.

“Miscellaneous” retailers – including pet stores and second-hand shops – were up at a 5.9% rate. And general merchandise stores – giant discounters to dollar shops – rose 4.3% as bargain-hunting remained a passion.

Other merchants shook off coronavirus challenges.

Electronics and appliance stores, weak after lockdowns ended, rebounded at a 4.6% annual rate. Car dealers, which finally had inventory to sell, saw sales up at a 6.3% rate. And another broad category – sports, hobbies, music and books – eked out a tiny 0.8% increase.

Glass half-empty

Noteworthy sales slumps were tied to the death of home improvement’s surge.

So sellers of furniture and furnishings saw sales dive 10.4%. Merchants peddling building and garden goods were off 0.5%.

Clothing dipped 1.5% as the limited back-to-the-office push keeps folks in informal wear.

And food and beverage stores lost 2.5% as consumers look in other places for grocery bargains.

Bottom line

The spending rebound was aided by continued job growth, moderating inflation and heavier credit card use.

Plus, less spending at gasoline stations thanks to falling pump prices – sales off at a 9% annual rate – was welcome news to other shopkeepers.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

’24 homebuying vs. history

How slow, by county? Click for details …

Los Angeles: 43% below average

Ventura: 42% below average

Orange: 39% below average

San Diego: 34% below average

San Bernardino: 23% below average

Riverside: 16% below average