If you want to see where California rents are rising the most – follow the paychecks.

Related Articles

What are Southern California’s best cities for renters?

Corporations want you to rent, not own. Can lawmakers stop them?

Menlo Park woman sentenced after scamming landlords to live for free

California rents, per square foot, rank 5th-highest in US

12 people compete for every rental unit in Silicon Valley, new study says

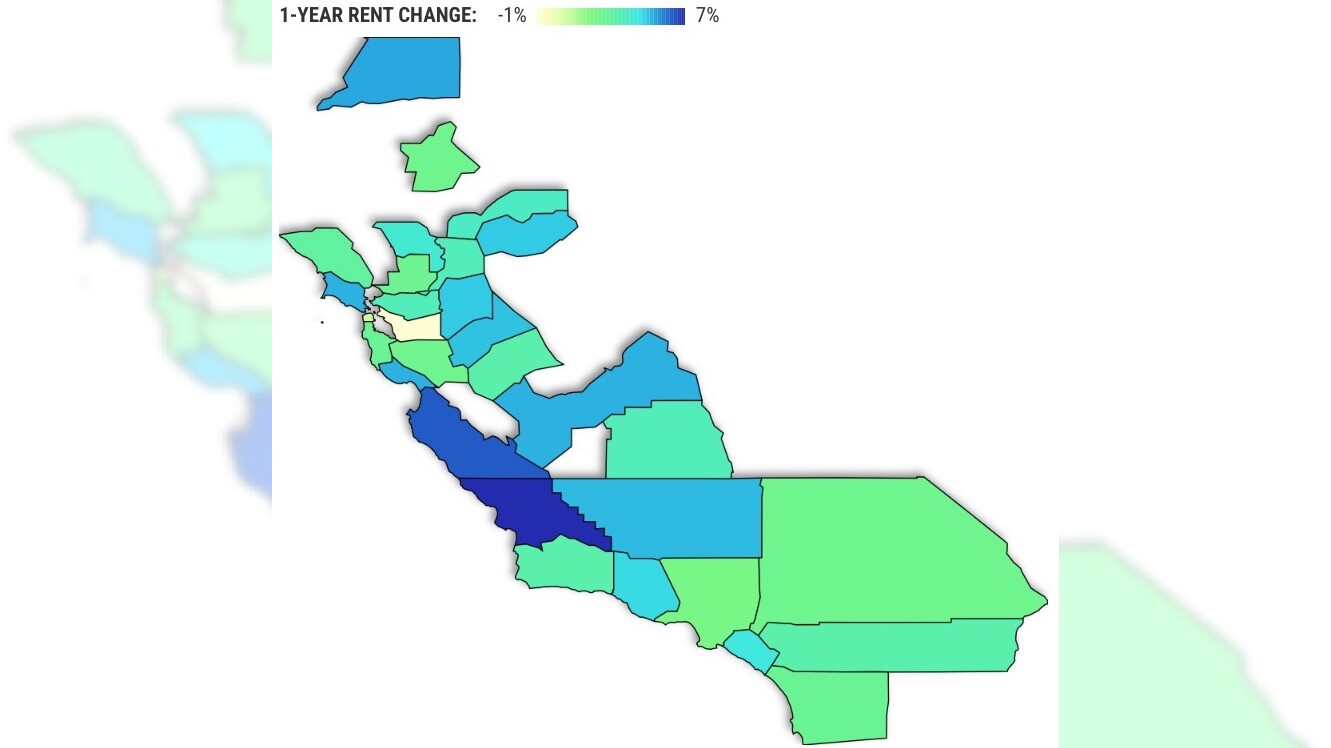

Let’s peek inside rent swings in California counties to see what landlords are charging and who’s hiring. My trusty spreadsheet looked at Zillow rent data for 30 big counties, comparing this spring (averages March to May) with 2023 and pre-coronavirus 2019. Those gyrations were matched up with the ups and downs of state employment tallies in those counties – counting how many residents have a job.

Think about the past year and how rents and work gyrated.

Of these 30 counties, the 12 with employment gains during the last 12 months averaged 3.8% rent increases. Meanwhile, the 18 counties with fewer workers had only 3.1% average rent hikes.

Lots of factor move rents – from how many folks need rentals to how many new units are built. But often we forget a force that helps drive housing – you need a paycheck to afford a place to live.

Puzzle pieces

Employment surges and retreats are key puzzle pieces to understanding the demand and pricing for housing.

It’s especially true in a crazy expensive place like California.

Look at the counties where rent rose the most last year. Yes, these five counties had mixed employment performance.

San Luis: Rents up 6.5% but 1.3% employment loss.

Monterey: Rents up 5.8% with 2.9% employment gain.

Shasta: Rents up 4.9% with 1.1% employment gain.

Fresno: Rents up 4.8% with 0.5% employment loss.

Santa Cruz: Rents up 4.8% but 0.4% employment loss.

But to see that jobs matter in real estate, focus on the counties with the smallest rent hikes. All had shrinking job markets.

San Bernardino: Rents up 2.2% with 0.6% employment loss.

Butte: Up 2.2% with 0.4% employment loss.

Los Angeles: Up 1.9% with 0.7% employment loss.

San Francisco: Up 0.5% with 2.5% employment loss.

Alameda: Down 1% with 1.2% employment loss.

Longer lens

The job market’s sway on rents is even clearer over the longer run.

Take a long lens and go back to spring 2019, well before the pandemic upended the economy.

The 14 counties with employment gains over these past five years averaged 43% rent increases. Meanwhile, the 16 counties with fewer workers had just 25% rent hikes.

Look at the counties with the biggest five-year rent hikes – and their paychecks …

Kern: 52% rent increase with 0.8% employment rise.

Santa Barbara: 52% rent increase but 1.8% employment dip.

Fresno: 51% rent increase with 1.8% employment rise.

Riverside: 48% rent increase with 4.4% employment rise.

Tulare: 47% rent increase with 4.9% employment rise.

Next, look at the counties with the weakest rent pricing since 2019. All had stumbling job markets in the period …

Contra Costa: 20% rent increase as employment dipped 3%.

Santa Clara: 11% rent increase as employment dipped 2.6%.

San Mateo: 7% rent increase as employment dipped 4.3%.

Alameda: 7% rent increase as employment dipped 3.4%.

San Francisco: 3% rent increase as employment dipped 4.9%.

Bottom line

Affordability matters, too, in an age where many workers can do their jobs remotely and relocate to cheaper locales.

Contemplate the 10 cheapest counties, as of this past spring. Rents averaged $1,974 – up 41% in five years, as employment rose 1.5% since 2019.

Contrast that to the high end, the 10 counties with the priciest rents.

These landlords get an average $3,297 a month cost – 67% higher than the cheapest markets.

And California renting’s upper crust only got 26% increases over five years. Why? Well, employment dropped by 3.3% in these job markets.

Now housing “bargains” are rare in California. So is it much of a surprise that four of the five cheapest counties for tenants have more employees than 2019?

Fresno: $1,922 rent, up 51% in five years, as employment rose 1.8%.

Kern: $1,809 rent, up 52% in five years. Employment up 0.8%.

Tulare: $1,802 rent, up 47% in five years. Employment up 4.9%.

Butte: $1,633 rent, up 25% in five years. Employment off 6.5%.

Shasta: $1,577 rent, up 41% in five years. Employment up 2.2%.

Conversely, California’s priciest spots for rentals are counties clustered near the Bay Area. It’s not been a pretty place for employment of late.

Marin: $3,914 rents were up 21% in five years. Meanwhile, employment dropped 5.3%.

Santa Cruz: $3,575 rent, up 36% in five years. Employment off 6.5%.

Santa Clara: $3,356 rent, up 11% in five years. Employment off 2.6%.

San Francisco: $3,323 rent, off 3% in five years. Employment off 4.9%.

San Mateo: $3,306 rent, up 7% in five years. Employment off 4.3%.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com