Could California lose its bragging rights as the world’s fifth-largest economy?

My trusty spreadsheet found that the Golden State could fall one notch in 2024 to fast-growing India in this theoretical ranking of economic heft, as measured by Gross Domestic Product – a broad measure of business output.

Let’s start by noting that California businesses produced $3.86 trillion worth of goods and services in 2023, as tracked by the US Bureau of Economic Analysis. Now, we’ll put that into a global perspective using figures from the International Monetary Fund.

In 2023, only four national economies were larger than California, by GDP math – the US at $27 trillion (that’s with California included), China at $17.7 trillion, Germany at $4.4 trillion, and Japan at $4.2 trillion.

But India wasn’t very far behind the Golden State in 2023 at $3.7 trillion. Then came the United Kingdom with a $3.3 trillion GDP and France at $3.1 trillion.

Next, we’ll peek at the IMF’s forecasts for 2024. India’s economy is projected to produce $4.11 trillion of goods and services this year. The US GDP in estimated to be $28 trillion.

So, if California produces the 14.5% share of US output it has averaged during the past two years, the Golden State would have $4.05 trillion in GDP in 2024.

That would translate to California falling just behind India – a nation with 1.4 billion residents, 36 times the Golden States’ population. Still, California would remain ahead of the United Kingdom, forecasted to be at $3.6 trillion, and France at a projected $3.2 trillion.

Not that California becoming “the world’s sixth-largest economy” is a shabby status, if it happens. But the potential demotion should serve as a reminder that California is constantly pushed to maintain its long-running standing as an economic leader – nationally and globally.

Slow year

Related Articles

Dollar stores are shutting down across America. They did this to themselves

Krugman: Good economy, negative vibes — the story continues

Bay Area office market flounders with empty space but demand jumps

Affordable San Jose homes may rise at Willow Glen restaurant site

Biden announces ‘life-changing’ relief from ‘crushing’ student loans

Yes, 2023 was a tepid year for California’s business climate.

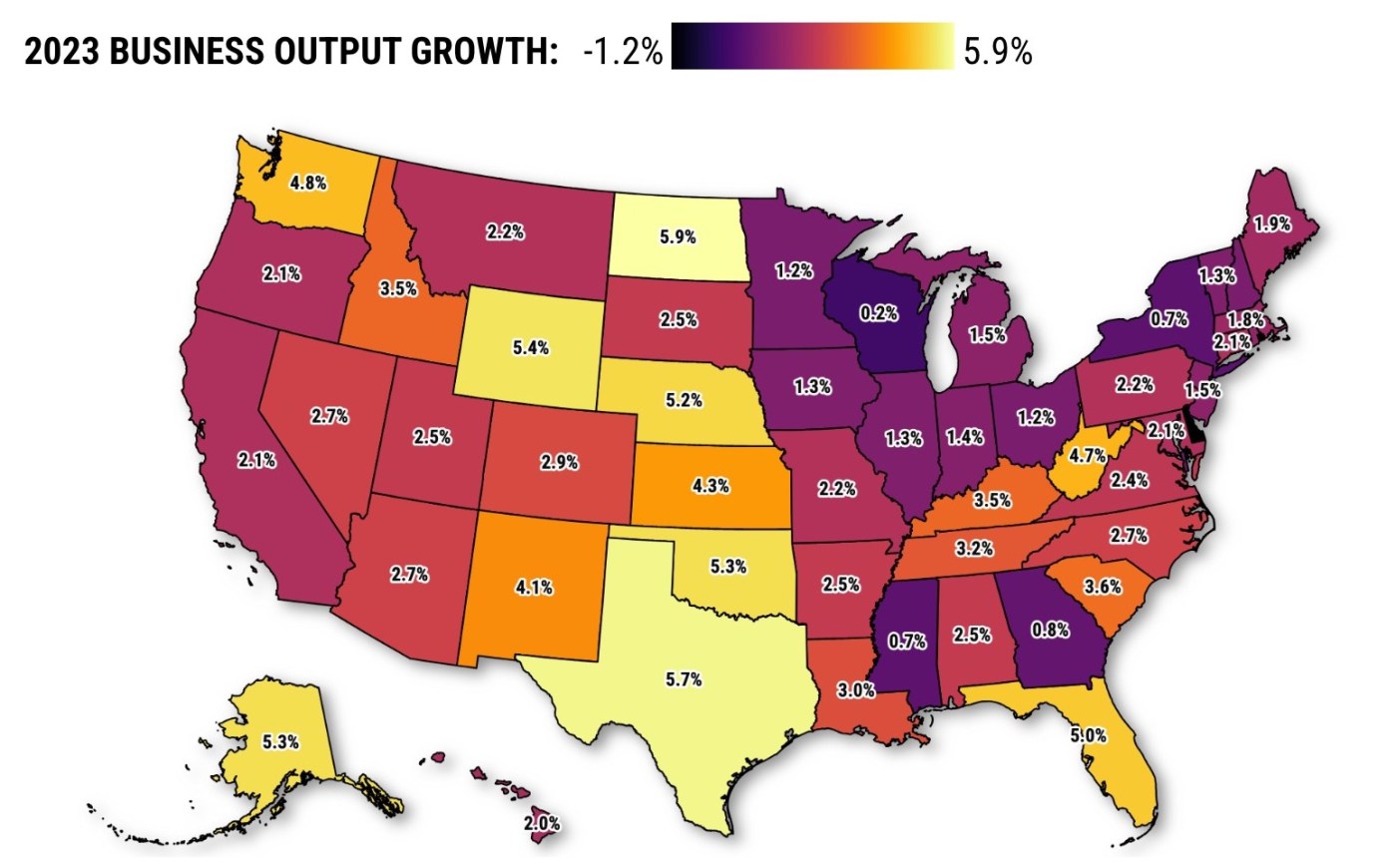

The statewide economy expanded by 2.1%, after inflation, as measured by GDP. That ranked No. 32 among the states and behind 2.5% US growth. Yet it was a noteworthy improvement from 2022 when California’s meager 0.7% growth – No. 41 among the states – was topped by the nation’s 1.9% expansion.

For 2023, the nation’s best growth was found in North Dakota at 5.9%. Delaware’s 1.2% drop was the worst. And California’s two big economic rivals expanded swiftly – Texas’ 5.7% was the nation’s No. 2 for growth, while Florida’s 5% was No. 7.

At least, the Golden State economy finished last year somewhat more robustly.

California’s business output grew at a 3.1% annual pace in the fourth quarter. Still, that ranked No. 29 among the states and trailed the nation’s 3.4% business expansion.

Nevada’s 6.7% growth was No. 1 in the quarter, and Nebraska’s 0.2% was last. Texas was No. 5 at 5% and Florida was No. 8 at 4.6%.

To be fair, try to think back one year ago when there was a fairly strong consensus among forecasters that 2023 would see a recession – locally, statewide and nationally. So here we are in early 2024 debating the intensity of California’s economic growth.

Look, many California businesses are still recovering from the harsh business restrictions of the pandemic era. Other businesses must adapt to the new normal of post-coronavirus life.

Additionally, California’s population continues to shrink. Plus, the past year’s high interest rates – designed by the Federal Reserve to tame an overheated economy – were especially harsh to a high-cost state like California.

Wins and losses

Consider swings in performance among key California industries in 2023, as measured by these GDP numbers.

On the upside, there’s the state’s information businesses – that’s all the computing know-how plus the creative types who make entertainment magic. Despite many technology industry troubles and a lengthy Hollywood strike, information was 2023’s biggest contributor to state business growth.

Retail was No. 2 for California growth, reflecting a curiously upbeat shopper. Professional services – primarily high-paying white-collar jobs – did well, too. State and local government spending also provided a significant boost. But this economic niche faces an uncertain future. Many governments expected to trim spending to meet steep budget deficits.

To the downside in 2023, California’s manufacturing of “nondurable goods” – think food, gasoline, apparel and health products – shrank the most in 2023. High costs for materials and labor were a hefty challenge for these businesses.

“Wholesale trade” – that’s warehouses – cooled off as supply channels got back to normalcy and shoppers decided to shop in-person at stores and trimmed using online merchants. Workers’ slow return to offices chilled the GDP contributions from administrative services. And high interest rates put a damper on California’s construction businesses.

Bottom line

California remains the nation’s economic giant.

The $3.86 trillion in goods and services produced in California in 2023 is by far the largest output in the nation. Texas was No. 2 at $2.6 trillion, followed by New York ($2.2 trillion), Florida ($1.6 trillion), and Illinois ($1.1 trillion).

And note that California’s output dwarfs all the goods and services produced in the nation’s 25 smallest state economies combined. Yes, roughly half of the nation equals the Golden State.

But heft does not guarantee future success. California leadership – political, industry and labor – should be wondering if subpar business performances in 2022 and 2023 are hiccups or signals of widening economic hurdles across the state.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com