”Survey says” looks at various rankings and scorecards judging geographic locations while noting these grades are best seen as a mix of artful interpretation and data.

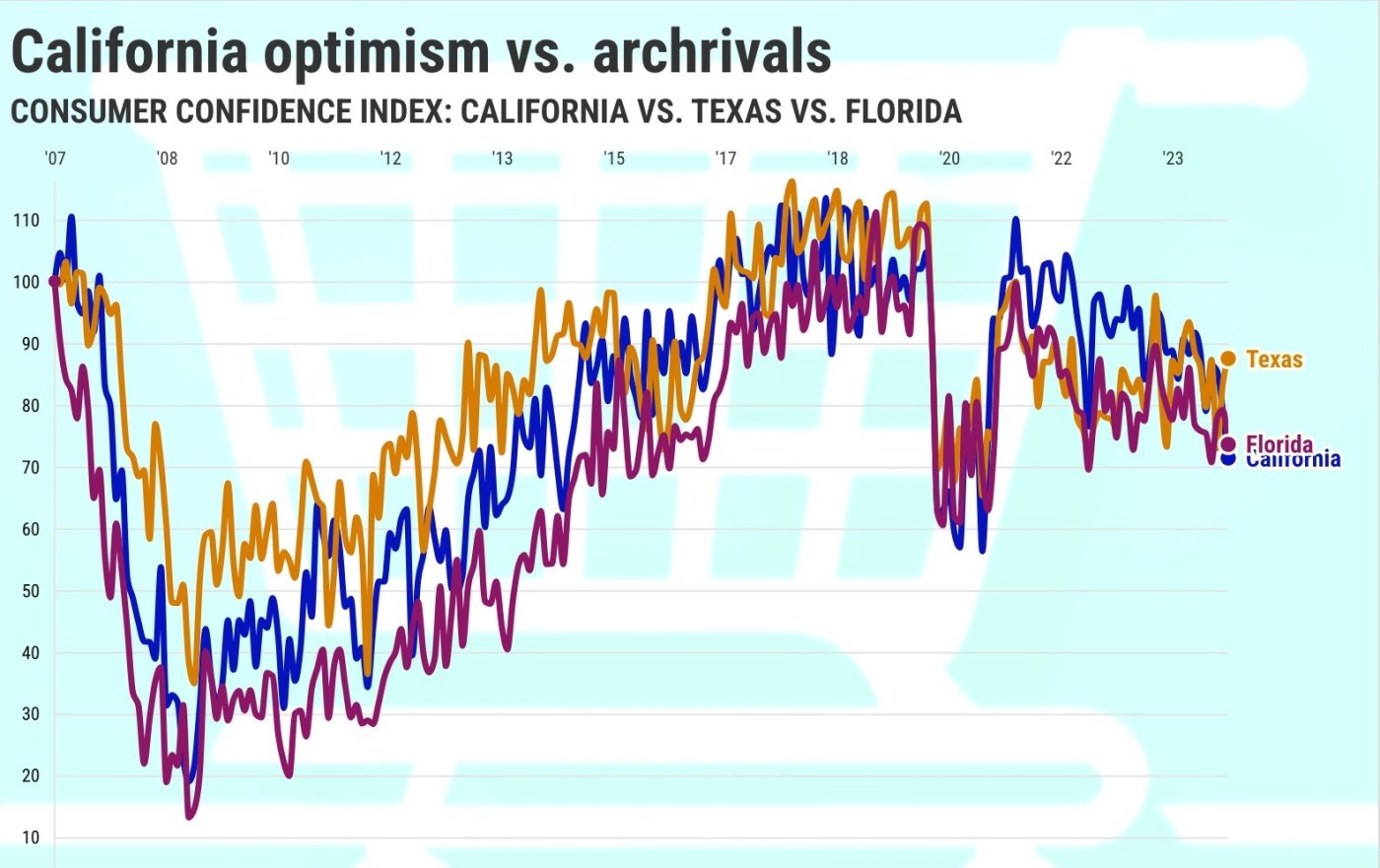

Buzz: California consumers have not been this depressed in four years.

Source: My trusty spreadsheet looked at August’s California consumer confidence index to see how all the economic news translates to shopper sentiment and compared those measurements with US optimism. The index is a key barometer for business owners and political policymakers in a big election year.

Topline

The last time California’s consumer confidence index was lower was May 2020 – smack in the middle of the pandemic lockdown’s economic muzzle. It’s also been a rough summer this year, according to this benchmark, with its yardstick of consumer psyche off 17% in two months, down 24% in a year – and 26% below pre-coronavirus 2015-19’s average results.

Two-plus years of the Federal Reserve’s elevated interest rates have clearly cooled the financial enthusiasm of Golden State shoppers. Widespread layoffs and rising unemployment have seemingly overshadowed the good news: continued hiring, generous raises and rising stock and home prices.

Nationally, consumer skittishness is far milder: a 6% dip in two months and a 5% decrease over 12 months puts it 10% below 2015-19.

Details

Related Articles

Gov. Newsom calls lawmakers into special session to address high gas prices

Do we really understand coffee? California’s new Coffee Research Center says ‘No’

Big San Jose shopping center lands new owners in $90 million-plus deal

Controversial California AI regulation bill finds unlikely ally in Elon Musk

Big housing project near San Jose train stop gets affordable revamp

Let’s ponder the two index slices that show steep drops in Californians’ view of today’s economy and future finances.

California’s “present situation” index is off 22% in two months, off 32% in a year, and off 32% vs. 2015-19. That a sharp contrast to the nation’s 1% dip in two months, 8% slide in a year, leaving it 6% below 2015-19.

The Golden State’s “expectations” measurement is off 11% in two months, off 16% in a year, and down 19% vs. 2015-19. Nationally, expectations are actually up 13% in two months but off 1% in a year and 15% below 2015-19.

Caveat

Even “red” states, including California’s two top economic rivals, have mixed economic views.

Texas consumer confidence is up 20% in two months, up 7% in a year, but off 11% vs. 2015-19. In Florida, optimism is down 5% in two months, and there’s been a 12% decrease over 12 months, with pysche is 16% worse than 2015-19.

Bottom line

Consumers, especially in California, don’t seem to like inflation nor its medicine.

The Conference Board’s broader US poll seeks feedback on prices and financing costs. Shoppers nationwide apparently to see a fix ahead in the next 12 months, at least according to August’s polling.

The median forecasted inflation rate from consumers was 4% – the lowest projection since March 2020. And 32% of those polled see falling interest rates – the highest level since April 2020.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com