As the November election approaches, a San Jose City Council candidate locked in a contentious race faces attacks about his past and present employment, including his ties to an unscrupulous developer and an unregulated home equity investment industry.

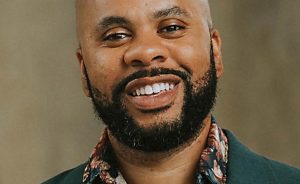

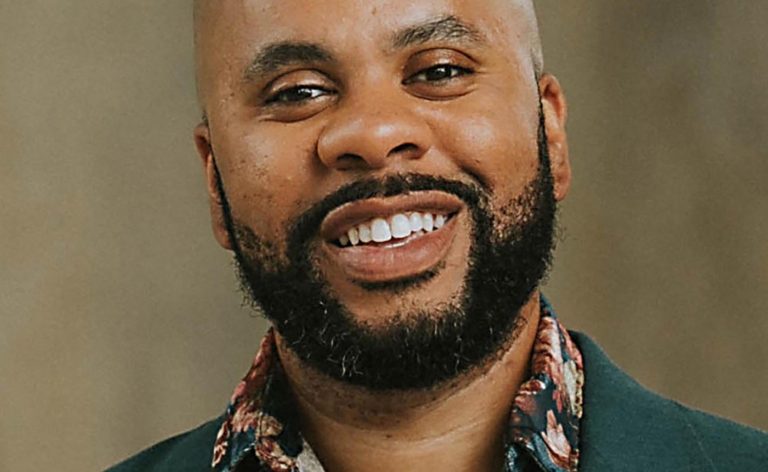

George Casey, who is challenging District 10 Councilmember Arjun Batra, previously worked as a consultant for Foster City-based Z&L Properties, a subsidiary of Chinese developer Guangzhou R&F Properties, tied to human trafficking, wage theft, and several unfinished projects throughout the city.

However, in an interview with The Mercury News, Casey defended his affiliation with the company and set the record straight about the circumstances of his involvement.

“Everything that was tawdry transpired years before I got there,” Casey said. “When I came on board, it was because they wanted to get out (of the market). They knew the writing was on the wall and a lot of the banks were taking some of these projects back, but they needed somebody that had integrity and could represent them and reach out to the community and sell these products because they had failed.”

Z&L Properties and its owner, Zhang Li, are connected to several San Jose and Bay Area projects that have come under scrutiny, including the construction of Silvery Towers. That project was thrown into the spotlight seven years ago after authorities discovered that Job Torres Hernandez, an unlicensed subcontractor, was holding immigrant workers in a warehouse and forcing them to work without pay.

Hernandez’s mistreatment of workers spurred San Jose to enact a new wage theft ordinance that would withhold a certificate of occupancy if contractors or subcontractors had an outstanding wage judgment against them.

Several of Z&L’s other projects have failed or been forced to be sold off, including the former Greyhound Station on Almaden Avenue. Its project at the First Church of Christ, Scientist on East St. James Street also drew the ire of city officials as a ripped tarp was wrapped over the building for an extended period, prompting the site to earn the name of “trash bag church.”

Casey said he was already working full-time in 2021 when the company approached him to help consult part-time on property sales and facilitate their transfers. He said he worked 10-15 hours per week during peak periods, pushing back on claims that he intentionally withheld the role from his resume.

“My goal was to get them out of their hands so they can actually build housing and create jobs,” Casey said. “That was the only reason I joined them. My reputation in the community has always been good. I wouldn’t run if I thought this was something that was going to embarrass me or my family.”

He partially attributed Z&L’s demise to its failure to adapt to doing business in America. Once it decided to leave the market, Casey said the company needed someone with the knowledge and connections to help offload its assets.

However, that proved to be a challenge and one of the reasons his tenure as a consultant was so short-lived.

“It was very dysfunctional, and it was potentially straining relationships I had with folks who were actually putting in bids to buy the property,” Casey said. “With the owner, we couldn’t make any decisions, and here, he would say, ‘Yes,” one moment and ‘No’ the next. It was very frustrating and dysfunctional that he couldn’t get anything done.”

Casey’s current role as senior counsel for Unlock Technologies also has led to criticism from his opponent, who questioned who Casey would serve as an elected official.

“How can he act like he’s a hero?” Batra said. “And then, he’s talking about being an ally to (San Jose Mayor) Matt Mahan. Who is he really going to serve?”

The unregulated financial product sells off a percentage of a home’s future equity in exchange for an upfront cash payment. Under the terms of the agreement, homeowners have the option of buying out Unlock Technologies within 10 years, but if the home price appreciates, the amount owed could be significantly higher than the original payment received.

Scrutiny over the industry prompted a bill in Washington state to call for regulation similar to mortgage lending and the Northwest Consumer Law Center to call the product deceptive and predatory. Several complaints filed with the Better Business Bureau made similar accusations.

Noting that the National Association of Realtors’ venture fund had invested in Unlock’s latest Series B funding round, Casey disputed the predatory claims while calling the criticism “much ado about nothing.”

“I don’t think it’s predatory and it’s not a lending loan,” Casey said. “It’s a fairly new product, so I think that has something to do with it. It’s in the process of being formally regulated.”

Although the bill stalled, the state’s Department of Financial Institutions launched an inquiry into the industry earlier this year. A report issued last week found that the terms of home equity-sharing agreements resembled those in many traditional loan products. The next step in the state’s inquiry is to assess how home equity-sharing agreements impact seniors, vulnerable populations and people of color.

While he acknowledged the risks if a home appreciates, Casey said the company would have some downsides if prices fall. He also noted that home equity sharing may give property owners access to cash they wouldn’t qualify for under traditional lenders.

“I think there’s a huge demand for it, and I think it provides folks locked out of traditional financing an opportunity to fix their financial situation,” Casey said. “We’re happy with the product and proud to give folks an opportunity to fix their financial situation.”