“How expensive?” tracks measurements of California’s totally unaffordable housing market.

The pain: Paying off the mortgage is a relative rarity in California.

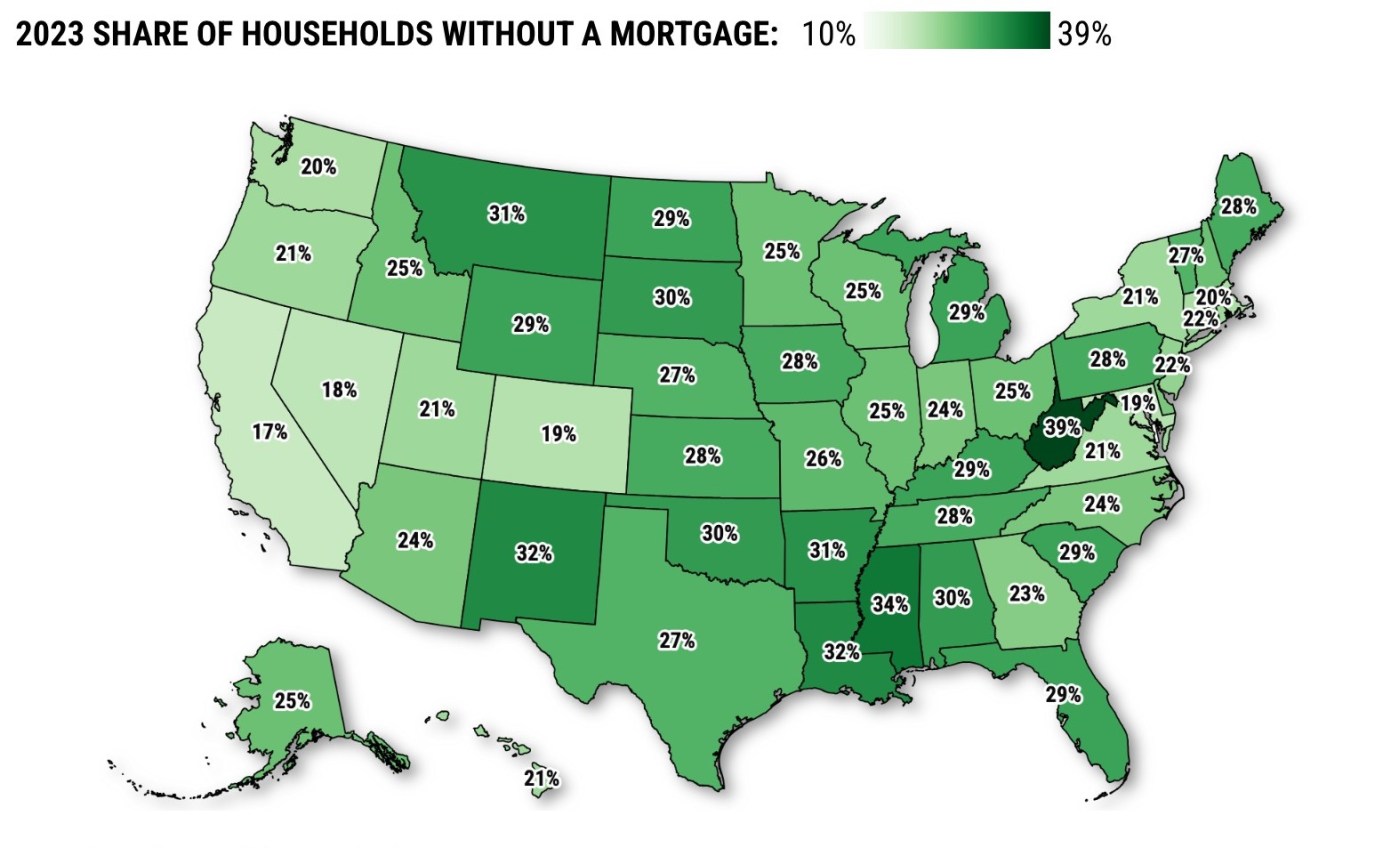

The source: My trusty spreadsheet looked at 2023 Census Bureau housing data that tracks how households pay for shelter in 50 states and the District of Columbia to quantify how many Golden Staters had reached no-mortgage status.

The pinch

Only 18% of California’s 13.7 million households live in a house they own without a mortgage. That’s a far thinner slice compared with the 26% of the 131 million US households that are mortgage-free.

And only Washington D.C., at 10%, has a smaller share of households without a mortgage. West Virginia was No. 1 at 40%.

Now, let’s look at other households. Start with the 38% of California households that own their home with the help of a mortgage. Those borrowers are the 11th-smallest slice among the states but it’s also just below the 39% share nationally.

Do not forget California’s large share of renters. Tenants paying rent represent 43% of Golden State households – third-highest behind D.C. (60%) and New York (45%). Nationally, it’s 33%.

And let’s note a curious slice tracked by Census – tenants paying no rent. These households, certainly blessed with generous landlords or curious living arrangements, are 1.4% of Californians (No. 34 among the states) and that’s below 1.6% nationally.

Pressure points

Mortgage-free living is growing. California had 2.5 million households without a mortgage last year, the third-largest tally among the state behind Texas (3.1 million) and Florida (2.6 million).

The Golden State’s no-loan owners grew by 12% from pre-pandemic 2019, the No. 28 gain among the states. Nevada was tops with a 24% jump. Nationally, 33.6 million owners were mortgage-free, up 13% in four years.

Still, no home loan doesn’t mean a household without housing costs. Remember, there’s pricier insurance, taxes, repairs, etc.

So no-mortgage homes cost their owners a median $834 a month in California in 2023, that’s the seventh-highest expense and is 33% above the U.S. norm of $629.

These expenditures rose by 34% in four years, the second-largest gain behind Colorado’s 37%. And it outpaced a 24% jump nationally.

Even a family budget with no home loan can be stretched by housing costs.

Last year, 17.8% of California’s mortgage-free households spent 30%-plus of their income on housing, a problematic level by some measurements. That’s the eighth-largest burden among the states and a slice that’s grown from 14.5% in four years.

Nationally, 15.2% of mortgage-less households spent 30%-plus on housing, up 12.5% in 2019.

Bottom line

If a personal finance pinnacle is paying off one’s mortgage, Californians do a poor job of it.

Obviously, the state’s high home prices mean giant mortgages that are a tough hurdle to pay off. Plus, many in California choose to stay in a mortgage in order to use those borrowed funds to help pay other lofty Golden State living expenses.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Related Articles

New transit-oriented housing near Ashby BART is closer to becoming a reality

The nation’s last refuge for affordable homes is in Northeast Ohio

Housing development is eyed on about 50 acres of empty San Jose land

Berkeley shifts approach to persistent homeless encampments

Housing agency pushes back on report over San Jose building blunder