With police and fire staffing stagnating, increased demand for emergency services, and flagging fire stations, Gilroy has turned to a quarter-cent tax measure to shore up public safety in the city.

While some say a tax hike would be counterproductive, most local leaders and emergency responders say the tax will be essential for keeping the city safe. Still, the measure must win a ⅔ vote to pass, placing a high bar of approval for Gilroy’s electorate.

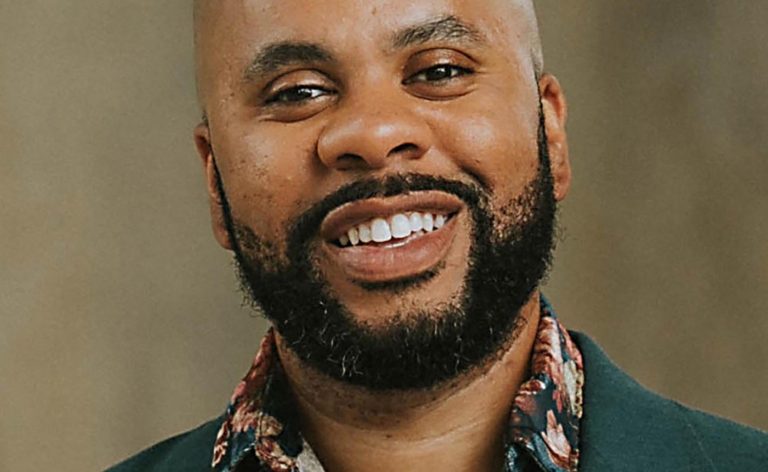

“This tax literally has a chance to save lives in this community … (It) would make us a survivable Gilroy,” said Steven Hayes, president of the Gilroy Firefighters Association. “This is literally an emergency tax.”

According to the city, the number of firefighters and police has virtually remained unchanged over the last decade. Meanwhile, the city has grown by about 15 percent, and Gilroy firefighters respond to 77% more calls than in 2012. That figure is exasperated by an ongoing paramedic shortage in Santa Clara county that at times forces firefighters to spend precious time waiting for ambulances when responding to a call, city staff said.

Given the growth, the city projects it needs to hire 15 police staff, add 17 firefighters, and build one more fire station. Additionally, two of the current fire stations need to be updated to be safe in the event of an earthquake, with one analysis concluding that the fire stations could collapse on a fire engine and render the firefighters there unable to respond to an emergency, according to former fire chief Jim Wyatt.

The proposed ballot measure, approved at a June council meeting, would bring local sales tax up to 9.375%, with exceptions for groceries and prescription drugs. The tax would apply to transactions that take place in Gilroy and would include items that are shipped in to the city. A seven-person oversight committee would be appointed by city councilmembers to ensure the funds were spent properly, and the funds would be subject to a yearly audit over how the taxes were collected and spent.

City staff estimates that measure could add between $4.1 and $4.7 million every year for staffing, infrastructure and equipment, with about half of that money expected to come from shoppers who live outside of the city.

While the money not enough to solve the staffing shortage, police and fire say the predicted influx of funds could be lifesaving to Gilroy residents.

While ideally, firefighters should respond to calls within 7 minutes and 30 seconds to ensure survivability on medical calls, according to Hayes, “there are times every day where response times are over 11 minutes.” By helping shore up staff for the fourth fire station — a converted recreational building which is currently only staffed part-time — the money could bring down response times across the city.

“We’ve overextended ourselves,” said Wyatt. “We want to meet this (response time), but we don’t have the funding to make that happen.”

For police officers, the extra funds could help the department keep up with the city’s growth, said Mario Rodriguez, president of the Gilroy Police Officers Association, who notes that an emergency like a stabbing may take all available police officers in the city, forcing the city to rely on California Highway Patrol to respond to calls.

Still, some are skeptical that the tax will solve the problem, arguing that the increased taxes would backfire on the city. Silicon Valley Taxpayers President Mark Hinkle maintained that the measure would “sabotage our recovering economy” by discouraging spending in Gilroy, in an official argument against the ballot measure.

City Councilmember Dion Bracco, who owns a towing company, worries that the tax could drive businesses — and the tax revenue they already brings in — elsewhere. “We have a lot of businesses in Gilroy that spend a lot of money on big ticket items…It may be a quarter-cent, but when you’re buying something for $500,000 it adds up,” said Bracco. (The tax increase would add an additional $1,250 to that $500,000 purchase.)

Nearby Hollister and Morgan Hill have sales tax rates of 9.250% and 9.125%, respectively.

Related Articles

Billions in Bay Area school bond funding sought on Nov. 5 ballot, but are voters tired of paying the bills?

Prop 5 would make it easier to pass Bay Area spending bills for housing, transit

PRO/CON: Is Prop. 35 the best way to help fund the Medi-Cal program?

Opinion: Proposition 35 harms the very communities it promises to help

Opinion: Prop. 35 will help ensure better health care for more Californians

City Manager Jimmy Forbis said in his experience with tax measures, he has not seen a mass exodus of taxpayers or businesses after an increase, in part because many costs are tied to brick-and-mortar spending that isn’t easily moved out of the city. And while he acknowledges the concern for major businesses, he notes that everyday shoppers are unlikely to notice the impact. (The measure would add another 25 cents to every eligible $100 purchase, for example.)

Ultimately, however, the measure is in the hands of the voters, who must weigh whether the increase in cost is worth a potential uptick in public safety and decide if the measure will win a two-thirds majority to pass.

“Who wants to pay more money? The Bay Area is already the most expensive place in the US to live, right?” said Gilroy resident Alicia Hernandez, who attended a forum on the tax measure. “I was on the fence, but … I’ll support it, just because I know the people behind these jobs, they put their lives on the line, and they should have facilities that are safe if they’re keeping us safe.”