San Mateo County Supervisors are urging Gov. Gavin Newsom to declare a state of emergency to help stabilize California’s home insurance market, which has seen rising costs and reduced availability.

In a resolution passed this week, the Board of Supervisors urged the governor to take swift action in response to the increasing challenges families and businesses face in securing property insurance. They are also calling on the state’s Insurance Commissioner, Ricardo Lara, and state lawmakers to expedite the usual lengthy process and quickly implement temporary rules to stabilize the insurance market.

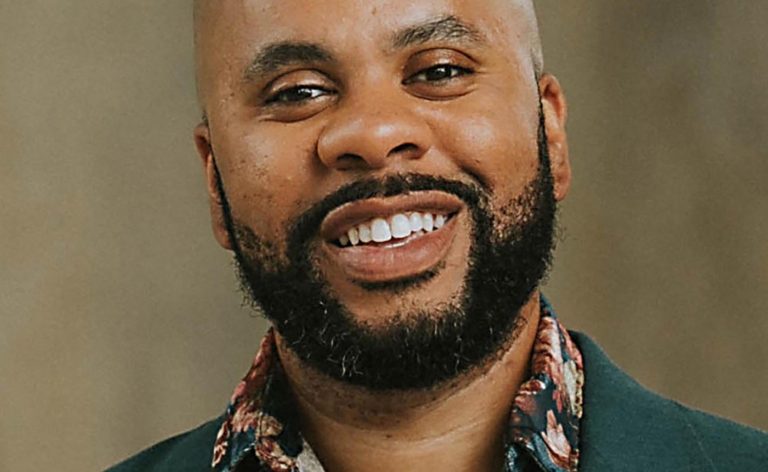

“Families and businesses in San Mateo County are on the brink, as the property insurance crisis threatens to leave them without protection for their homes, livelihoods and future,” said Supervisor Ray Mueller, who represents the county’s coastal areas.

“Insurance options are shrinking while natural hazard risks from wildfire and storm surge grow, community-serving development projects in the wildland-urban interface stall and small businesses face closures,” Mueller said. “Our request, along with other counties (such as Placer County, San Bernadino and Shashta County), for a state of emergency is an urgent call to secure a fair, stable insurance market that keeps our communities safe and resilient in the face of an increasingly unpredictable climate future.”

The insurance crisis has worsened in recent years, with insurers dropping coverage for hundreds of thousands of homeowners in fire-prone areas. Homeowners unable to secure traditional policies have had to turn to the costly FAIR Plan, California’s insurer of last resort. Meanwhile, major carriers like State Farm and Allstate have stopped issuing new home insurance policies statewide, leading to fewer options and contributing to rising premiums.

Related Articles

Some California homesellers are letting buyers who can’t get insured pull out of deals

Prop 35 would raise money for Medi-Cal health services to low-income families, seniors, disabled residents

State Farm projects dropping 1 million policies in California over next five years

Insurance cancellations banned for Southern California wildfires

Wildfire risk upends California’s marijuana heartland as insurance vanishes

Mueller highlighted that while the California Insurance Commissioner has proposed regulations to address the crisis, they won’t take effect until at least 2026. “The California Insurance Commissioner has broad authority under the Insurance Code to adopt emergency regulations to promote the public welfare,” Mueller said. He said the commissioner could act now by issuing emergency rules to fast-track insurance rate changes and other measures to stabilize the market.

Other counties, including Shasta and San Bernardino, have also called on Gov. Newsom to declare a state of emergency to prevent insurers from dropping policyholders and to bring stability to the state’s insurance market.

The California Department of Insurance said that the regulatory goals outlined in San Mateo County’s resolution align with the ambitious reforms of Commissioner Lara’s “Sustainable Insurance Strategy,” launched last September.

“The Department is moving at the speed of transparency and good decisions — with openness and public participation — on a multitude of administrative actions and urgent regulations to enact the state’s largest insurance reform in 30 years since the passage of Prop. 103 in 1988,” it said. “We appreciate the County’s support of our ongoing regulatory work to solve this insurance crisis and stabilize our state’s insurance marketplace in order to benefit and protect consumers while increasing the availability of insurance.”

Newsom’s office did not immediately respond to a request for comment.