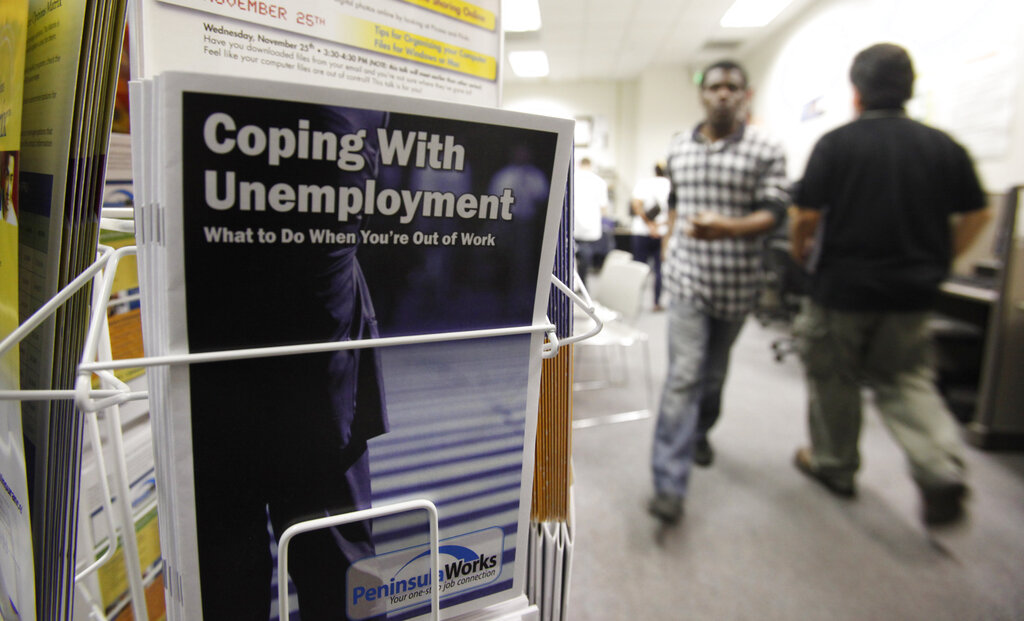

When the Great Recession struck California 17 years ago and hundreds of thousands of workers lost their jobs, the state’s unemployment insurance system crashed.

The employer-financed program quickly exhausted its thin reserves, due to a short-sighted political decision six years earlier.

In 2001, the Unemployment Insurance Fund had a $6.5 billion positive balance. But the governor at the time, Democrat Gray Davis, owed big political debts to unions that financed his 1998 campaign. He repaid them by doubling unemployment insurance benefits, contending that the seemingly hefty reserve could cover them without raising payroll taxes on employers.

When recession struck, the insurance fund soon leaked red ink and the state borrowed about $10 billion from the federal government to maintain cash payments. When the state didn’t repay the loan, the feds raised payroll taxes for nearly a decade to retire the loan.

It should have been a lesson for political policymakers about instant gratification and financial responsibility, but it wasn’t.

Shortly after the $10 billion loan was paid off, California was hammered by the COVID-19 pandemic, and upwards of 3 million workers lost their jobs as the state ordered workplace closures.

Once again, the unemployment insurance program had virtually no reserves to cover the sharp increase in claims. Once again it borrowed from the federal government, this time for $20 billion, and once again its failure to repay forced the feds to increase payroll taxes.

In addition to a double dose of financial problems, the Employment Development Department has also experienced managerial failures.

In 2011, Elaine Howle, the state auditor, laid out the department’s shortcomings in a sharply worded report, but when the pandemic hit, they once again became evident. There were massive glitches in responding to legitimate claims for insurance benefits, while the department gave tens of billions of dollars to fraudsters.

Meanwhile employers are still repaying the last loan, and the state’s insurance fund is continuing to run deficits, unable to cover current benefits of nearly $7 billion a year.

With that history in mind, another watchdog agency, the Legislative Analyst’s Office, is urging a complete overhaul of unemployment insurance, declaring the system “is broken.”

Noting that the current state payroll tax cannot fully cover current benefits, much less build reserves, the LAO report projects a “perpetually outstanding federal loan” to keep payments flowing that must be repaid with interest.

The report proposes a four-part tough love approach to a crisis that has been building for more than two decades and cannot solve itself, to wit it advises the state to:

• Increase the taxable wage base from $7,000 per worker to $46,800, tying it to the actual benefits of up to $450 a week. It “would place California among the ten states with taxable wages bases above $40,000 and all other Western states.”

• Adopt two payroll tax rates, one to cover current benefits and another to rebuild reserves. The combined rate of 1.9% would be applied to the $46,800 wage base.

• Base employers’ tax rates on their changes in employment, thus imposing higher costs on employers that reduce their number of workers.

• Refinance the federal loan with a bond backed by payroll taxes and state loans from its internal sources to reduce overall interest costs.

Related Articles

Tufekci: Bird flu pandemic would be one of history’s most foreseeable catastrophes

French: Loyalty of FBI pick Kash Patel is a threat to the rule of law

Krugman: Trump’s brand of crony capitalism is coming to America

Opinion: If Trump deports farm workers, who will pick California’s crops?

Opinion: Trump’s of Stanford professor Jay Bhattacharya pick to lead the NIH gets some things right

There may be other alternatives, perhaps affecting benefits, but the main thing is that doing nothing will just perpetuate this crisis — even though the politics of the issue are daunting.

It’s been a political stalemate for nearly a quarter-century, pitting unions seeking to protect, or even increase, benefits against employers who don’t want to shoulder increased taxes. Successive governors and legislative leaders have shunned engagement, preferring to kick the can down the road.

Dan Walters is a CalMatters columnist.