The hopes of California tenants that a wave of apartment construction might provide more rent relief may be fizzling in early 2024.

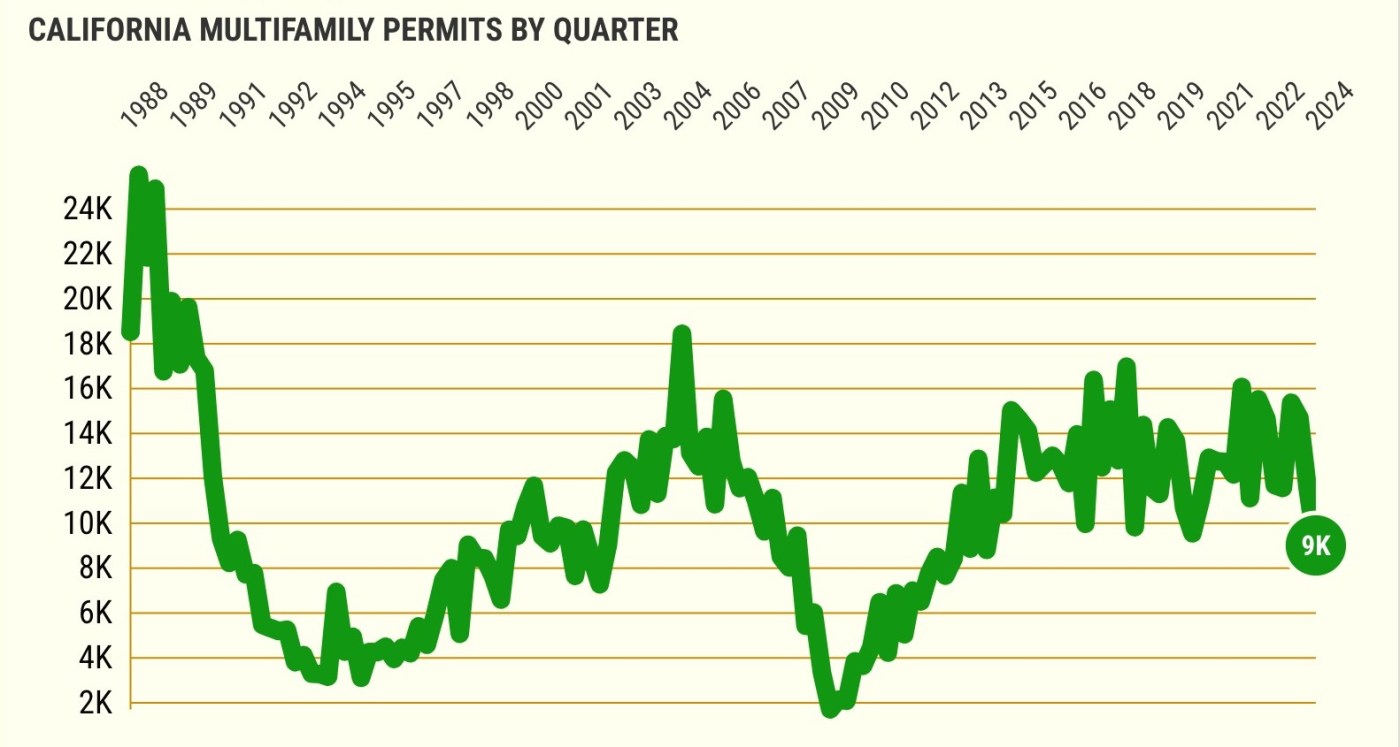

Construction plans for multifamily housing plunged to a 10-year low, my trusty spreadsheet found after peeking at quarterly California building permit patterns from the Census Bureau complied by the St. Louis Fed. Multifamily housing is primarily apartments plus certain ownership condos or townhomes.

Related Articles

Tenant advocates in this Bay Area city are close to putting rent control on the ballot

Concord tenant protections to be implemented after attempt to block them with referendum fails

Elias: California tenants surprisingly faring best in the pricey Bay Area

Opinion: How wealth worsens California’s housing crisis and what lawmakers can do

California rent ‘bargains’ are disappearing. Which ones are left?

California permits approved for multifamily housing in the first quarter fell 22% below 2023’s start to 8,972 units in this year’s first three months. That’s the slowest quarter for multifamily plans since the start of 2014.

California developers cooled their building plans as interest rates soared, the economy slowed and folks no longer felt the pandemic-fueled need for larger living spaces.

And let’s not forget that California rents have flattened as vacancies increased. No amount of legislation or nudging will get developers to build when economic conditions aren’t near-perfect.

Sadly, the year’s slow start contrasts sharply with a previously swift pace of multifamily housing construction in California.

The first quarter’s permitting ran 32% below the 2021-23 pace. In those three years, 159,476 multifamily units were in the works. That was the largest construction effort since 2004-2006. Yes, 17 years.

Renter relief

A new supply of rentals helped to ease the pain of sharp rent hikes in the pandemic era.

California rents were falling at a 1.4% annual rate in March 2024 after falling 0.8% for all of 2023, according to ApartmentList. Don’t forget that rents statewide rose 11% in 2022 and 5.5% in 2021 as tenants sought larger living spaces as the coronavirus retooled life and the economy.

Let’s also consider empty California rentals and the options they provide apartment seekers. In 2024’s first three months, vacancies averaged 5.2% vs. 5% in 2023 and 4% in 2022, according to ApartmentList.

Some hope

California house hunters fared somewhat better. Developers of single-family homes, sped up their construction pace to meet demand for ownership properties.

Single-family permits rose 26% in the first quarter to 14,215 units. But that was 7% off the 2021-23 pace. In those 3 years, 182,883 houses were permitted, roughly unchanged from the previous 3 years.

Overall, California permits were 23,187 units in the first quarter, up 2% from a year ago but off 19% from 2021-23’s pace. In those 3 years, 342,359 permits were filed, the best count since 2005-2007.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com