By Michelle F. Davis, Lucas Shaw and Christopher Palmeri | Bloomberg

Walt Disney Co. and streaming provider FuboTV agreed to combine their online live TV businesses, creating the second-biggest digital pay-TV provider.

Related Articles

Demi Moore ‘clearly’ ignored Kylie Jenner in new Golden Globes snubbing drama

12-year-old East Bay baker competing on Food Network ‘Kids Baking Championship’

Complete list of winners at the Golden Globe Awards

Yes, Zendaya was wearing an engagement ring at the Golden Globes: reports

After 45 years, Demi Moore wins first major award proving she’s no ‘popcorn actress’

As part of the transaction, Disney will fold its Hulu + Live TV business into Fubo, creating a new venture that will be 70% owned by Disney and the rest by Fubo, Disney said in a statement on Monday, confirming an earlier Bloomberg report. With a combined 6.2 million subscribers in North America, the new venture will trail only YouTube TV.

The deal doesn’t include Hulu’s subscription video business, in which customers pay a fee to stream a catalog of content at their leisure. The TV venture will continue to operate under two brands: Fubo and Hulu + Live TV.

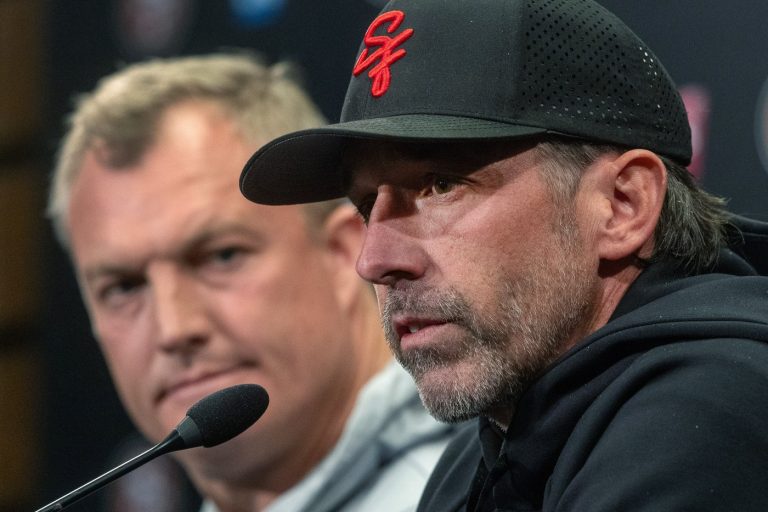

Fubo co-founder and Chief Executive Officer David Gandler will operate the newly combined Fubo and Hulu+ Live TV business.

“This combination enables us to deliver on our promise to provide consumers with greater choice and flexibility,” Gandler said in the statement. “Additionally, this agreement allows us to scale effectively, strengthens Fubo’s balance sheet and positions us for positive cash flow. It’s a win for consumers, our shareholders, and the entire streaming industry.”

Shares of Fubo nearly tripled on Monday to $3.99 as trading opened in New York, the biggest jump since January 2018. Disney shares were up about 0.7%. Fubo, which had a market value of about $481 million on Friday, will remain publicly traded. As the smallest virtual TV operator, it has faced challenges including expensive programming and subscriber churn.

Fubo is a virtual multichannel video programming distributor, which means it offers live TV channels over the internet as opposed to over cable, satellite or fiber. Hulu’s Live service, an alternative to cable TV, lets users stream from roughly 100 live TV channels including sports, news and shows.

Combining the services should position the venture to attract subscribers as customers look for online alternatives to cable TV.

In connection with the transaction, Disney will enter into a new carriage agreement with Fubo that will allow Fubo to create a new sports & broadcast service, featuring Disney’s premier sports and broadcast networks, including ABC and ESPN. Fubo, which streams more than 55,000 live sporting events annually, will continue to serve subscribers in the Fubo App. And Hulu + Live TV will continue to be streamed in the Hulu app and be offered as part of the bundle with Hulu, Disney+ and ESPN+.

As part of the deal, Fubo has settled all litigation with Disney and ESPN related to Venu Sports, the sports streaming platform planned by Disney, Fox Corp. and Warner Bros. Discovery Inc. Last year, Fubo sued Disney, Fox and Warner Bros. claiming the proposed joint venture would be anti-competitive. Venu Sports plans to provide access to live sports events from several major leagues, including the National Football League and the National Basketball Association. It will also include content from Disney’s ESPN and Warner Bros.’s TNT networks.

The Venu partners will make a cash payment to Fubo of $220 million, according to the statement. In addition, Disney has committed to provide a $145 million term loan to Fubo in 2026.

Wells Fargo & Co. is lead financial advisor to Fubo and Evercore Inc. is also serving as financial advisor. Latham & Watkins LLP is Fubo’s legal advisor in the deal. Centerview Partners LLC is Disney’s financial advisor and Cravath, Swaine & Moore LLP is serving as legal advisor.

–With assistance from Thomas Buckley.