By Giles Turner | Bloomberg

A small stake in the San Francisco Giants is for sale at a price that could value the team at about $4 billion, according to people familiar with the matter.

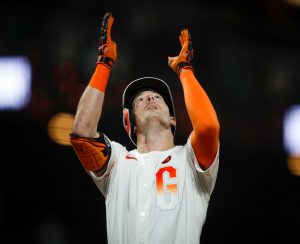

The Major League Baseball team is owned by around 30 partners, including former catcher Buster Posey and investor Arctos Sports Partners. Charles B. Johnson, 91, a former chief executive officer of Franklin Templeton Investments, holds the largest stake at about a quarter.

The stake is less than 5% and related to estate planning, the person said, who asked not to be named discussing private information.

A spokesperson for the Giants didn’t immediately respond to a request for comment.

A consortium of investors led by Peter Magowan bought the Giants in 1992 for $100 million. The team has since become one of the more profitable teams in the league, and has invested in redeveloping its waterfront stadium.

The financial success of the Giants is in stark contrast to the troubled Oakland Athletics, which will play in West Sacramento, California, for three seasons beginning next year, ahead of the team’s planned move to Las Vegas.

Minority stake sales in sports teams have often passed hands unannounced, but the rapid rise in team valuations has brought extra attention to changes in ownership.

Related Articles

SF Giants minor-league report: Does rotation solution exist in Sacramento?

Nevin, Allen homer, Miller converts 4-out save as Oakland A’s beat New York, split four-game series at Yankee Stadium

A’s lose to Yankees as balk to Judge bites Boyle; Gelof likely to hit IL

Sean Manaea stymies SF Giants, bullpen not up to snuff in Blake Snell’s stead

Blake Snell’s rocky start with SF Giants continues, landing on injured list

A’s owner John Fisher recently said he is open to selling a minority stake in the team. Sportsology Capital Partners Ltd. and Ares Management Corp. are in exclusive talks to buy a stake in the Texas Rangers, valuing the team at $2 billion, Bloomberg reported in December.

Unlike other sports, new majority ownership for MLB teams has been relatively rare, with only a handful of teams changing hands over the past decade.

Earlier this year, David Rubenstein and a consortium of investors bought a controlling stake in the Baltimore Orioles, in a deal that values the team at $1.73 billion. The New York Mets, Kansas City Royals, Miami Marlins and Seattle Mariners have also changed hands since 2016.

Sign up for Bloomberg’s Business of Sports newsletter for the context you need on the collision of power, money and sports.

–With assistance from Randall Williams.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.