Roughly one out of every 10 Los Angeles homeowners lacks insurance – a share on par with statewide trends, according to one estimate.

My trusty spreadsheet reviewed LendingTree’s tracking of how many owners lacked home insurance in 2023. Analysts at the loan-referral service looked at the Census Bureau’s housing cost data and assumed owners spending less than $100 in a year on insurance meant no coverage.

In Los Angeles County, struck in recent days by a series of devastating wildfires, 9.8% of homeowners were uninsured, by this math – 154,100 out of 1.57 million homes.

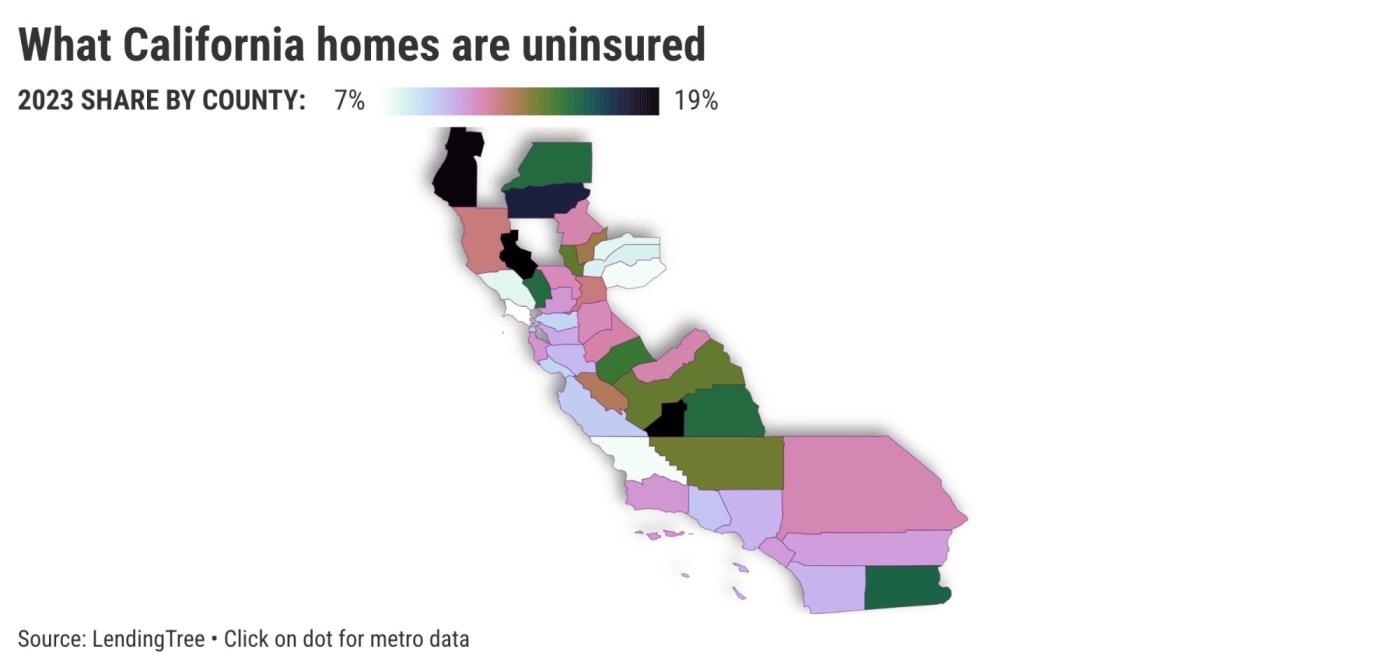

Across all of California, LendingTree found 806,600 owners without coverage out of 7.66 million residences. That’s 10.5% of all homeowners.

Statewide, the share of uninsured runs above 19% in three counties – Lake, Kings and Humboldt. Meanwhile, another trio is below 7%: Marin, El Dorado and San Luis Obispo.

“The high wildfire risk in California has led to insurance companies withdrawing from underwriting policies in some parts of the state or limiting coverage for perils like wildfire, making it even harder for homeowners to find affordable policies that provide them with the protection they need,” says Divya Sangameshwar, a LendingTree home insurance analyst.

California home insurance premiums have risen 48% in the past five years, according to LendingTree.

However, this isn’t just a California cost issue. Rates nationwide are up 38% in the same period.

Location. Location. Location.

Owners with less to lose seem willing to take the no-insurance bet.

At the county level, uninsured homes tend to be concentrated in less-populated parts of the state.

The 14 counties with the highest uninsured levels rates have a combined 752,000 homes, 15% of which are not covered. The 14 counties where no insurance is the least frequent, there are 3.78 million homes with 9% lacking coverage.

What’s financially at stake is also a factor, comparing these geographic extremes with November’s median home-sale prices from the California Association of Realtors.

The typical house price in low-coverage counties was $436,000 vs. $1.06 million where insurance was most common.

Postscript

Here are coverage details for some of the state’s other most-populated counties …

Orange: 10.5% uninsured – 65,200 of 622,600 homes.

San Diego: 9.8% uninsured – 62,900 of 643,300 homes.

Riverside: 10.4% uninsured – 57,100 of 547,300 homes.

San Bernardino: 11.2% uninsured – 47,900 of 428,500 homes.

Santa Clara: 9.6% uninsured – 34,700 of 360,200 homes.

Sacramento: 12.1% uninsured – 41,700 of 345,000 homes.

Alameda: 10.1% uninsured – 33,100 of 328,200 homes.

Contra Costa: 8.8% uninsured – 25,200 of 285,300 homes.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Related Articles

Letters: Next Alameda County DA must embrace Care First

What the Los Angeles fires might mean for the Bay Area home insurance market

Southern California wildfires add to growing worries about homeowner insurance

Tips for handling insurance claims after a disaster

League seeks volunteers to register new citizens as voters