Over the last two years, the San Francisco Bay Area has shed 60,000 technology jobs, roughly 10% of the tech workforce at its peak in late 2022. This decline — combined with rising homelessness, empty BART trains, empty office buildings, and population declines — has led to a crisis in confidence in Silicon Valley.

Is the region losing its role as the heart of the tech industry? The answer is not yet. But to understand the risks that do exist, local policymakers need to pay less attention to the short-run movement in tech jobs, and more attention to a far more worrisome dilemma: the declining labor force and an inadequate housing supply.

Evidence suggests the recent decline in the Bay Area tech industry is cyclical, driven largely by the pandemic and the Federal Reserve’s response to the crisis. When COVID-19 forced Americans home, demand for social media soared. And the $5 trillion stimulus the Fed injected into the U.S. economy sent asset prices soaring and led to an enormous surge in venture capital funding into the Bay Area economy. According to data from Pitchbook, new funding more than doubled from $43 billion in 2020 to $92 billion in 2021. It’s little wonder that tech jobs leapt to all-time highs in 2022.

The bubble deflates

However, the excessive stimulus also spurred inflation, leading the Fed to rapidly pivot from easing to tightening. The wave of VC money disappeared as fast as it showed up, and funding fell by a two-thirds between 2021 to 2023, even as vaccines conquered the pandemic and allowed people to venture back into the real world. It should be little surprise that the industry has slimmed down from those heady pandemic years.

Most importantly, the worst appears to be over. VC funding is again on the upswing and tech jobs in the region have stabilized. In the meantime, the Bay Area still receives a larger share of VC funding than any other region in the nation and maintains a dominant number of tech jobs — nearly double that of Dallas and Austin.

This isn’t the first time the Bay Area has seen the impact of a deflating tech bubble. The region lost almost one-third of its tech jobs between 2000 and 2004 after the dot-com equity bubble of the late 1990s burst, a proportionately steeper slide than the recent declines. Still, the Bay Area never lost its place as the heart and soul of tech in the United States.

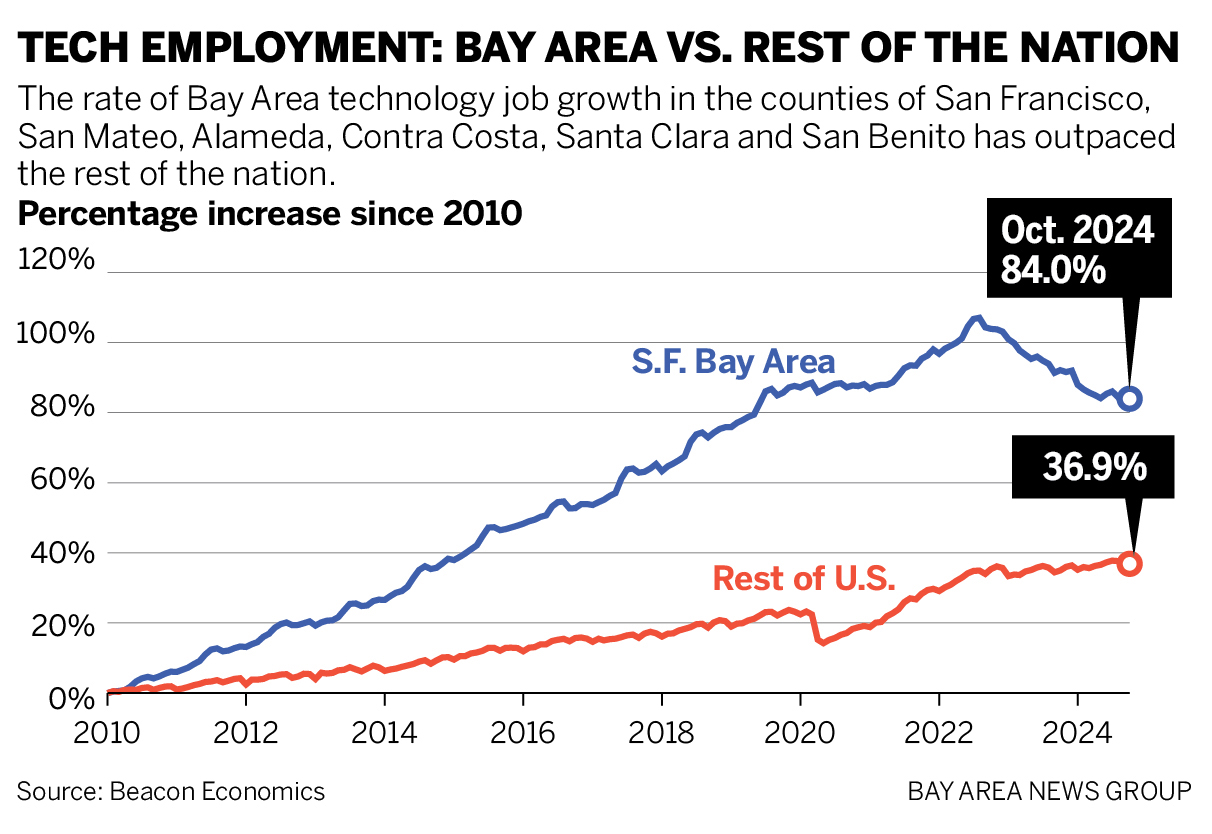

When the industry started booming again after the Great Recession, it was the Bay Area that was home to the surge. According to data from the state Employment Development Department, the counties of San Francisco, San Mateo, Alameda, Contra Costa, Santa Clara and San Benito doubled tech jobs from 300,000 in 2010 to 600,000 in 2022.

A 10% decline from that peak seems a small-scale price to pay considering the remarkable growth over the past decade. In total, tech jobs in the Bay Area are still up 84% over the past 15 years, compared to 37% for the rest of the nation. During that time, the Bay Area’s share of the nation’s tech jobs increased from 6.9% to 9.1%.

Still, do not expect another tech surge in the Bay Area — although that prediction has nothing to do with the business climate or the region’s ability to compete in the tech arena. It’s about the region’s ability to grow at all.

Labor force contracts

Over the past two years, tech employment losses have erased the gains of the previous three years, leaving job levels where they were in 2019. But over the same period, the Bay Area’s labor force has shrunk to levels last seen in 2016. Tech employment now uses 16% of the region’s labor supply, the highest share recorded since before the pandemic. The total labor force continues to contract even as tech jobs have stabilized. How can tech expand if there is no one in the labor force left to hire? How can startups flourish when the region’s tech titans have already snapped up the available labor force?

Related Articles

OpenAI whistleblower’s death fuels ‘conspiracy theory’ boosted by Elon Musk, Tucker Carlson, Bay Area congressman

Goldberg: Can the Democrats be the party of the future again?

In the Bay Area Desi community, it’s all about culture, tradition and bonding

Meta to lay off more than 3,600 workers in latest shakeup

Travel back to San Jose’s wild days at the massive History Park

This workforce contraction has been driven in part by the region’s shrinking population — a 150,000-person decline over the past two years. The core issue? A shortage of housing. This seems contradictory because the stock of housing has actually grown. The problem is that while population has contracted, the number of households has increased over the past five years. This was primarily driven by a sharp decline in the number of people per household, something fueled by rising incomes and demographic shifts.

Bay Area leaders are right to fret about empty office buildings and declining tech employment, but they have yet to focus on the real problem and, thus, the real solution: a dramatic increase in housing supply. This problem has been acknowledged for years and is becoming increasingly critical. Housing permits in the region declined from 27,000 in 2018 to just 13,000 in the past year.

As the Bay Area waffles on this acute issue, states like Texas and Washington are eagerly waiting in the wings to take companies who might prefer to stay in California, but simply can’t due to the lack of an available labor force. More housing is the key to ensuring the Bay Area’s tech industry stays on top — and time is of the essence.

Christopher Thornberg is founding partner of Beacon Economics.