Here’s the California home insurance debacle made simple: No more bargains.

Property owners are keenly aware of the state’s numerous risks to their property, most notably wildfires. But they might be surprised to learn that California home insurance policies are among the nation’s cheapest.

How often do we say “low” regarding any Golden State housing cost?

Such thriftiness translated to California essentially asking insurers to take a high-risk gamble with low rewards. Would you make this bet?

Insurers knew it was a losing gamble, so they increased their odds of success by removing the highest-risk customers. That’s why so many Californians lost their home insurance.

Now, economics is rarely straightforward. Yet this crisis is a textbook example of what can occur when prices are kept too low: the supply of the product suffers.

How low?

It’s time for the trusty spreadsheet.

Contemplate three yardsticks of property risk in the 48 states of the continental United States – an overall hazard ranking from CoreLogic, a measurement of insurance losses from PolicyGenius, and SmartAsset’s estimate of overall potential damages.

No surprise. California’s average score translates to the nation’s second-riskiest place for property owners.

Next, contemplate five measurements of annual home insurance premiums paid last year – from Nerdwallet, Insure.com, Bankrate, Value Penguin and Insurify.

Surprise! California’s average cost ranks as the ninth lowest among the 48 states.

Do you see a worrisome gap? Look at what’s charged in the 10 riskiest states, by this math, and what homeowners pay to cover an average $470,000 of damages from those hazards.

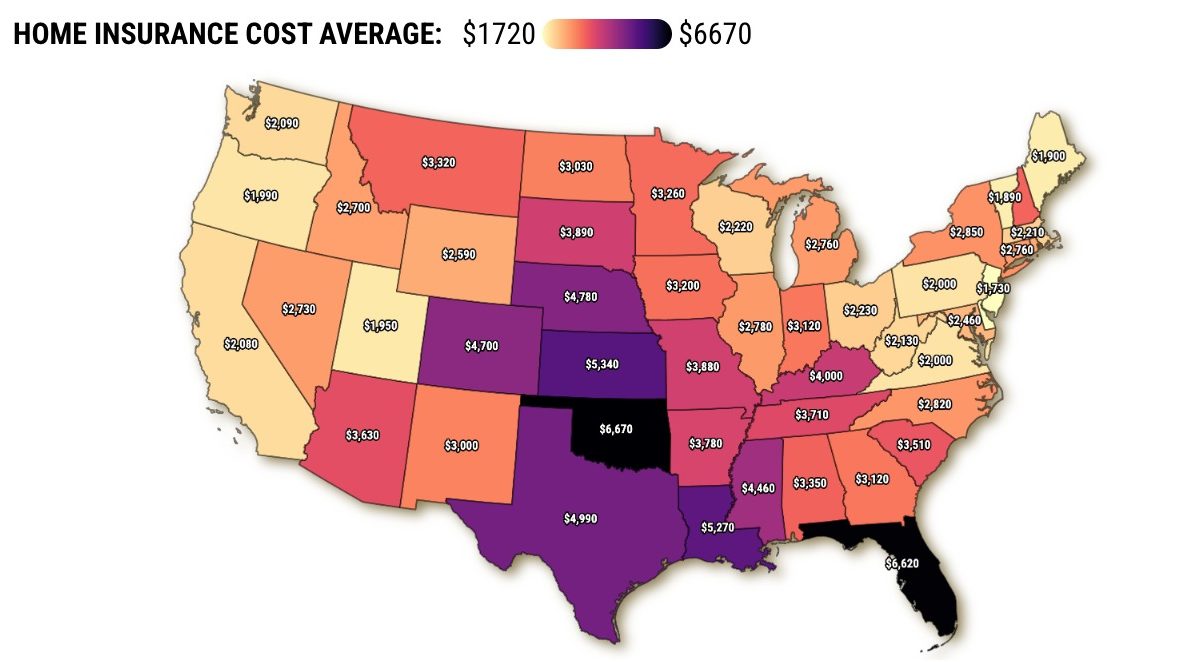

Florida homeowners live at the most peril and pay accordingly. Their typical annual premiums of $6,620 are the second highest of the 48.

Contrast that risk-rate mix to California, which is No. 2 on this hazards scorecard. Premiums across the state average only $2,080 yearly, No. 40 out of 48 states.

The Golden State seems equally out of step when looking at the remainder of the Top 10:

No. 3 Nebraska at $4,780 (No. 6 cost).

No. 4 Texas at $4,990 (No. 5 cost).

No. 5 Louisiana at $5,270 (No. 4 cost).

No. 6 South Dakota at $3,890 (No. 10 cost).

No. 7 Mississippi at $4,460 (No. 8 cost).

No. 8 Kansas at $5,340 (No. 3 cost).

No. 9 Oklahoma at $6,670 (No. 1 cost).

No. 10 Alabama at $3,350 (No. 16 cost).

Note that policy costs in these high-risk states, minus California, averaged $5,040 – roughly 150% more than Golden State prices.

And the 48-state average policy of $3,200 is 50% above California’s cost.

What reform?

Insurance companies are not saints, but you want them to be profitable.

Why? You may need them to write you an enormous check one day. That’s a key reason why California and other states have regulatory powers over insurers. However, California insurance laws tied to voter approval of Proposition 103 in 1988 made it tricky for the industry to get adequately compensated for the risks they take.

Even before the devastating Los Angeles County wildfires, California’s rate-risk mismatch set the stage for soaring insurance premiums.

As insurers dropped policies, Californians rushed to the FAIR Plan, a last-resort insurer funded by the insurance industry. It protected 450,000 homes as of September – more than double its 2020 flock.

Plus, 1 in 10 Californians chose not to buy home insurance at all, according to one estimate.

This put pressure on state regulators to get more coverage from traditional insurers by letting those companies charge more.

For much of 2024, new pricing rules were debated. Numerous forces battled over the nuances of so-called insurance “reform” – head-scratching concepts like reinsurance and catastrophe models.

Yet it’s not really about “reform” – it’s about “how much?”

I know the typical California homeowner doesn’t want to hear this, but home insurance has been a relative bargain – with a potentially costly twist.

The Palisades and Eaton firestorms were the nightmare the insurance industry was trying to avoid – especially considering the limited premiums they could collect.

So the FAIR Plan is stuck with a chunk of the mammoth damage bill. Sadly, this insurance program may not have enough cash or financial backstops to pay the giant tab.

Again, surprise! The FAIR Plan could refill its financial hole by collecting a surcharge that would boost future California home insurance premiums for all property owners.

Please make sure your household budget knows what’s coming. Your insurance bill will surely rise to better reflect property risks.

Plus, you may be charged for a curious indirect cost of historically cheap policies – some of the FAIR Plan’s tab for rebuilding Pacific Palisades and Altadena.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

Related Articles

Wildfire-risk models are struggling to predict Los Angeles-style fires

Why all California homeowners could be on the hook for LA County wildfire costs

Will California insurance reforms be enough to stop insurers from leaving?

1 in 10 Los Angeles homes don’t have insurance, says one estimate

What the Los Angeles fires might mean for the Bay Area home insurance market